The momentum of the equities market persisted from 2023, into 2024, with the S&P 500 hitting new all-time highs in February. As a fellow investor, I was interested to find out what were the most popular stocks to buy now (amidst this phenomenal rally). For those of you searching for the answers, I think you’re at the right place!

We’ve recently conducted a survey amongst 3,276 investors & traders in our Piranha Profits community, with the aim of finding out which stocks are getting the most attention… and boy, were there some interesting picks. Curious to know which stock took the crown? Keep reading to find out!

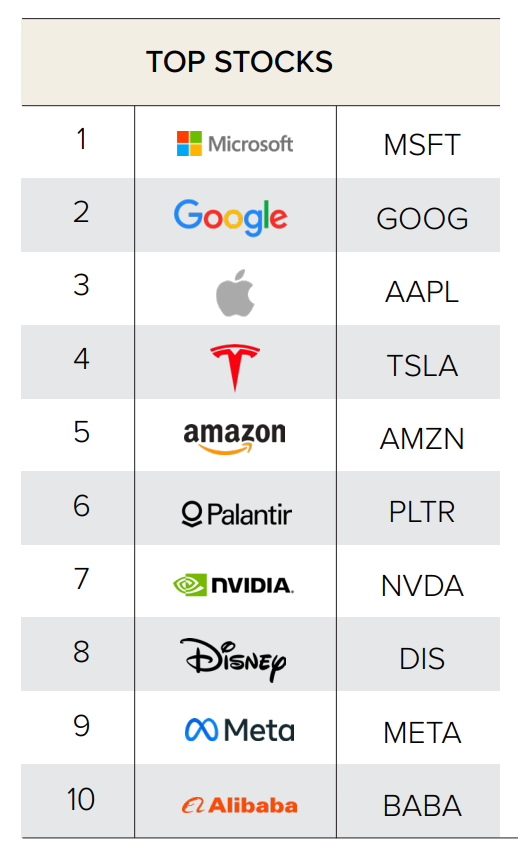

Top 10 Most Popular Stocks Amongst 3,276 Investors & Traders

We did this survey at the end of 2023, asking this question “What are the Top 3 stocks on your watchlist right now?”

Source: Piranha Profits’ Exclusive: “Dumb Money” Report

Unsurprisingly, the Magnificent 7 sits tightly in the Top 10, with honorable mentions; Palantir, Disney and Alibaba alongside them.

If you were to dig deeper under the hood, these two groups have polar opposite characteristics. The Mag 7 had a great run in 2023, most experiencing significant gains of between 48% to nearly 240%. Palantir has also made one of the biggest comebacks in its history, capitalizing on the current AI wave and their position as a key player in the data analytics space.

Alibaba and Disney on the other hand… continued to grind down investors’ optimism.

Now, here’s the interesting thing. Just 1 month ago, on the 11th of January, Microsoft surpassed Apple’s market cap to become the world’s most valuable public company again. Call this the law of large numbers, or the wisdom of crowds – but it seems like the majority has made their expectations clear, Microsoft is the fan-favorite.

For those of you who are interested in a deeper dive into this most popular stock, we’ve made a YouTube video detailing our thoughts on it.

Popular Stocks to Buy Now, Yay or Nay?

Here’s our view on the list of Top 10 stock names right now, along with some key financial metrics that we like to look at.

Microsoft Stock Analysis (MSFT)

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

MSFT |

34.76 |

14.18% |

22.93% |

42.41% |

25.83% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

We view Microsoft very favorably due to the software empire that they’ve managed to build over the years – entrenching their moat as the King of Software. Furthermore, they’ve recently been embarking on this aggressive journey with OpenAI (creator of ChatGPT) and Copilot, which has reinvented how some of us work.

As an organization, they’ve executed on a world-class level, which the market has rewarded correspondingly with a world-class valuation. The biggest challenge moving forward; Can they continue to execute in such a spectacular fashion?

Alphabet Stock Analysis (GOOG)

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

GOOG/GOOGL |

21.65 |

19.26% |

37.1% |

23.26% |

29.25% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Alphabet’s claim to the throne (~90% share of the search market) did not happen overnight. AI is integrated in every part of their business, from search results to optimizing navigation on Google Maps and most importantly, enhancing ad effectiveness via their troves of data and analytics.

However, the seemingly “cheaper” valuation compared to its counterparts - is a vote of no confidence as many deem Alphabet to be underscoring its potential and not executing good enough (from the delayed announcement of Bard, to the slow implementation of Gemini)

Alphabet, being the original benefactor of the Artificial Intelligence trend, has yet to lead the pack in introducing new technological advancements to the world.

Apple Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

AAPL |

28.23 |

9.29% |

18.92% |

147.44% |

32.55% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Apple is the King of Cash Flow – where they’re essentially buying up $75 - 100 Billion worth of shares every year for the last 3 years. Despite growing concerns around Apple’s maturity in the smartphone business, they have been growing their bottom line religiously due to the massive share buyback program, given the strong free cash flow profile they are able to deliver due to their superior brand equity.

Furthermore, they’ve recently cracked into the AR/VR industry with the introduction of the Apple Vision Pro, and it has received very positive feedback from the ground. Looking forward, investors should still monitor the iPhone sales and service revenue as it will provide the next leg of growth for Apple’s business.

Tesla Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

TSLA |

57.48 |

45.47% |

171.98% |

21.08% |

16.36% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Tesla, which used to be the Darling of Wall Street as they’ve overturned the entire automobile and electric vehicle industry, is now facing several headwinds - from a prolonged high interest environment (which dampens demand) to increased competitive pressure (which reduces margins).

It was no longer the EV company that dominated the entire automobile industry, with a backlog of demand so huge that it could charge premium prices due to the lack of supply. Moving forward, many long-time investors are still monitoring closely on the developments of Full-Self Driving, Energy Storage and Distribution, Robotics and many more.

For now, investors of Tesla do not view it as a company that only manufactures cars, and it is reflected in their valuations today.

Amazon Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

AMZN |

40.22 |

21.93% |

28.65% |

21.95% |

8.53% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Amazon, also known as the “Anything Store”, has evolved into an Advertising giant, a Cloud Computing leader, and a formidable logistics provider rivaling FedEx and UPS. People often forget that Amazon was able to climb to the top precisely because they were able to fully capitalize on their advanced technological capabilities.

In their most recent earnings report, they’ve once again proven their worth in generating immense cash flow from their past investments – rebounding greatly from their abysmal performance in the last two years.

Palantir Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

PLTR |

73.59 |

30.91% |

N.A. |

N.A. |

N.A. |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Palantir, being a relatively new company on Wall Street (after going through a direct-public-offering in 2020) is causing waves in the AI analytics market today. They’re essentially in the business of converting big data to actionable insights for their enterprise customers - with the help of AI.

Despite its short track record, investors are optimistic about the superior platform Palantir is able to offer and are rallying behind this “once-in-a-generation” opportunity. We do see great potential in Palantir’s future growth, but there are still many executional risks along the way that needs to be monitored closely.

NVIDIA Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

NVDA |

58.49 |

27.01% |

32.3% |

29.78% |

44.42% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Nvidia is in the business of designing chips, and they’re phenomenal at what they do. Currently, they dominate the discrete GPU (Graphic Processing Unit) market, with more than 80% market share. These dGPUs are the bedrock to power and run most AI applications and models today.

Don’t be misled by the seemingly low revenue and earnings per share growth over the last five years. In the last two quarters alone, NVIDIA has basically doubled and tripled their revenue on a year-on-year basis. All things considered, the biggest question for most investors today is how long they’re able to sustain such growth in sales and margins.

Disney Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

DIS |

23.82 |

9.73% |

11.52% |

2.42% |

2.99% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Disney has been a core memory for many of our childhood years, delivering blockbuster content and experiences. However, as a business, they had to grapple with a messy leadership transition, the cannibalization of their legacy cable business and the high churn rate of their streaming business with Disney+.

To add fuel to the fire, the current content lineup is not creating enough excitement amongst Disney fans - resulting in disappointing box office numbers, and they do show in the horrendously low ROE and ROIC figures posted by the business.

Looking forward, the biggest question for current and prospective investors is will Bob Iger be able to steer the ship back, and how long will it take for Disney to be effective in building and monetizing their brand equity again.

Meta Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

META |

23.08 |

21.3% |

13.63% |

25.42% |

28.57% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Meta, pouring in tens of billions of dollars into the AR/VR space - yet yielding minimal returns were the main concerns amongst shareholders in 2022. After Mark Zuckerberg’s “Year of Efficiency” declaration, Meta was able to re-focus their efforts on the core business and consistent investment into their algorithm and products enabled them to entrench their position as the King of Social Media and Queen of Digital Advertising.

Alibaba Stock Analysis

|

Stock |

Forward PE Ratio |

Revenue/share Growth (5Y) |

Diluted EPS Growth (5Y) |

ROE |

ROIC |

|

BABA |

8.2 |

27.88% |

N.A. |

18.39% |

6.99% |

Source: Gurufocus & Seekingalpha (accurate as of 14Feb2024)

Alibaba, although crowned as the King of Ecommerce in China, is slowly losing its magic to fellow competitors like Pinduoduo and ByteDance. They are currently managing a slowing Chinese economic environment, intense competition, changing regulatory framework and an overall weak investor sentiments – which all led to the abysmal stock performance.

Moving forward, Alibaba’s management team has pledged to focus on their core business while driving efficiencies across the rest of their business verticals. In their effort to reward shareholders, they’ve upsized their share buyback program and maintained their commitment to giving out dividends. Therefore, the investor base of Alibaba has transitioned from one of being growth-driven to dividend-preferred.

Conclusion

If you’re interested in how other investors are thinking about the markets today, you can Download a Copy of The “Dumb Money” Report - a Piranha Profits Exclusive, where we dove deeper into understanding the current market sentiments, how investors and traders performed in 2023 - and how are positioning their portfolio and funds, what they’re focusing on, and their criteria for investing moving into 2024.

You will also be getting our latest stock market analysis and tips every week!

submit your comment