The top question on most investors’ minds every day — What are the best stocks to buy now in 2023? Picking the best stocks out of the nearly 6,000 listed stocks in the US stock exchange is no easy feat.

One way to get inspiration for stock ideas is to look at the “superinvestors”. Simply put, what the big-name investors are buying and holding.

As Warren Buffett famously said, “Price is what you pay, value is what you get.” These investors can sell for a thousand and one reasons, but they buy for only one reason — because they see value.

In this article, we will take a deeper dive into the Top 10 stocks the superinvestors are accumulating, and see whether they’re really the top stocks for 2023.

Table Of Contents:

The Superinvestors' Top 10: Best Stocks to Buy Now in 2023?

- What are Superinvestors?

- Top Stocks for 2023 According to Superinvestors

- Technology Companies (Microsoft, Alphabet, Amazon & Meta): Best Stocks to Buy Now in 2023?

- Financial Stocks (Visa, Mastercard, Wells Fargo): Best Stocks to Buy Now in 2023?

- Berkshire Hathaway: Best Stock to Buy Now in 2023?

- Healthcare Stocks (UnitedHealth Group): Best Stock to Buy Now in 2023?

- BONUS: What Superinvestors Have been Buying Over the Last 6 Months

The Superinvestors’ Top 10: Best Stocks to Buy Now in 2023?

What are Superinvestors?

Superinvestors are commonly a group of individuals or funds that manage large sums of capital. They tend to be highly respected for their market insights and analysis as most of them have had a long track record of making money from the stock market.

Examples of superinvestors include:

- Warren Buffett – Berkshire Hathaway (AUM $293 Billion)

- Bill Ackman – Pershing Square Capital Management (AUM $10.8 Billion)

- Seth Klarman – Baupost Group (AUM $5.5 Billion)

(AUM stands for “assets under management”)

Top Stocks for 2023 According to Superinvestors

Based on figures from Dataroma*, these are the top 10 most owned stocks amongst the 78 superinvestors they are currently tracking;

|

Stock |

Ownership Count ^ |

% of Ownership by Superinvestors Combined |

|

Microsoft Corp. |

32 |

2.75 |

|

Alphabet Inc. |

31 |

1.64 |

|

Alphabet Inc. CL C |

27 |

1.97 |

|

Amazon.com Inc. |

24 |

1.75 |

|

Visa Inc. |

24 |

1.52 |

|

Meta Platforms Inc. |

22 |

1.95 |

|

Berkshire Hathaway CL B |

20 |

1.59 |

|

Wells Fargo |

18 |

1.03 |

|

Mastercard Inc. |

17 |

1.16 |

|

UnitedHealth Group Inc. |

17 |

0.53 |

Source: Dataroma (^ sorted by Ownership Count), data accurate as of 09 November 2023)

*Dataroma is a website that tracks portfolios of prominent investors by extracting data from their financial filings, which allows us to see their exact holdings (as of the time of the reporting), but the reports tend to be disclosed within the next quarter – and the manager could have already sold out of their position. Therefore, these buy/sell actions should only be taken with a pinch of salt.

Technology Companies (Microsoft, Alphabet, Amazon & Meta): Best Stocks to Buy Now in 2023?

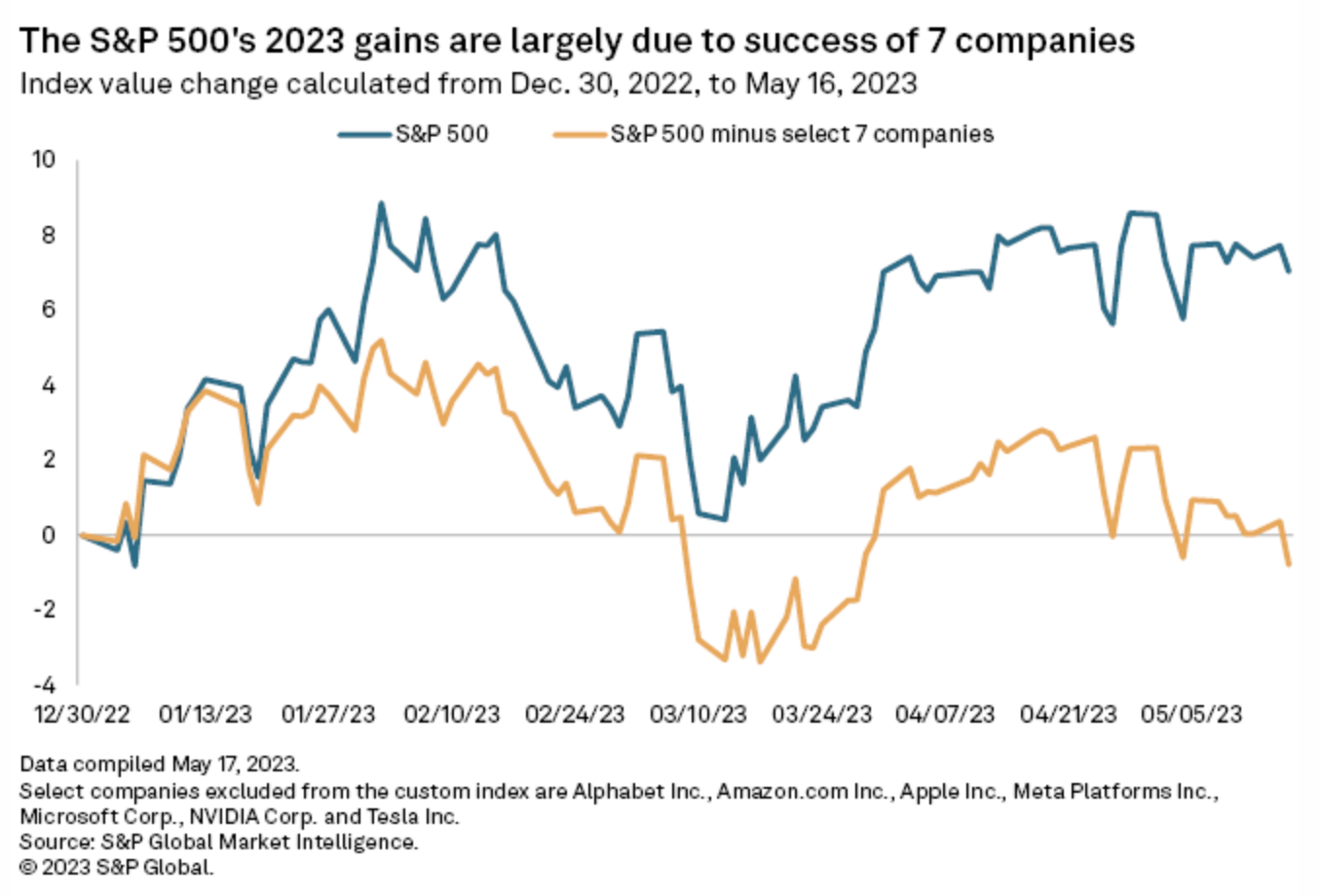

In 2023, the Magnificent 7 contributed substantially to the performance of the overall S&P 500 index (SPY).

We can also observe a clear trend amongst superinvestors today having a keen interest in accumulating technology companies, specifically Microsoft, Alphabet, Amazon and Meta out of the seven, with these stocks dominating most of their portfolios with an outsized allocation.

When it comes to these mega-cap technology companies, it is pretty intuitive to have large capital allocated to them. Most, if not all of them are leaders in their own rights, with huge economic moats (such as network effect, economies of scale, brand equity, strong ecosystem etc.) that fend off competition easily. This dominance has allowed them to reap an extraordinary amount of profits and cash flows.

Investors might be wondering if it is still a good time to enter some of these technology stocks, especially after this year’s huge run-up. We have documented our thoughts on which are the best tech stocks to buy now in a separate article. Overall, we believe that many of these tech companies are sitting on a long-term secular growth trend, with strong opportunities of growth ahead of them.

Discover the latest hidden opportunities our 7-figure mentors are watching at BLACK MARKET 2023.

Financial Stocks (Visa, Mastercard, Wells Fargo): Best Stocks to Buy Now in 2023?

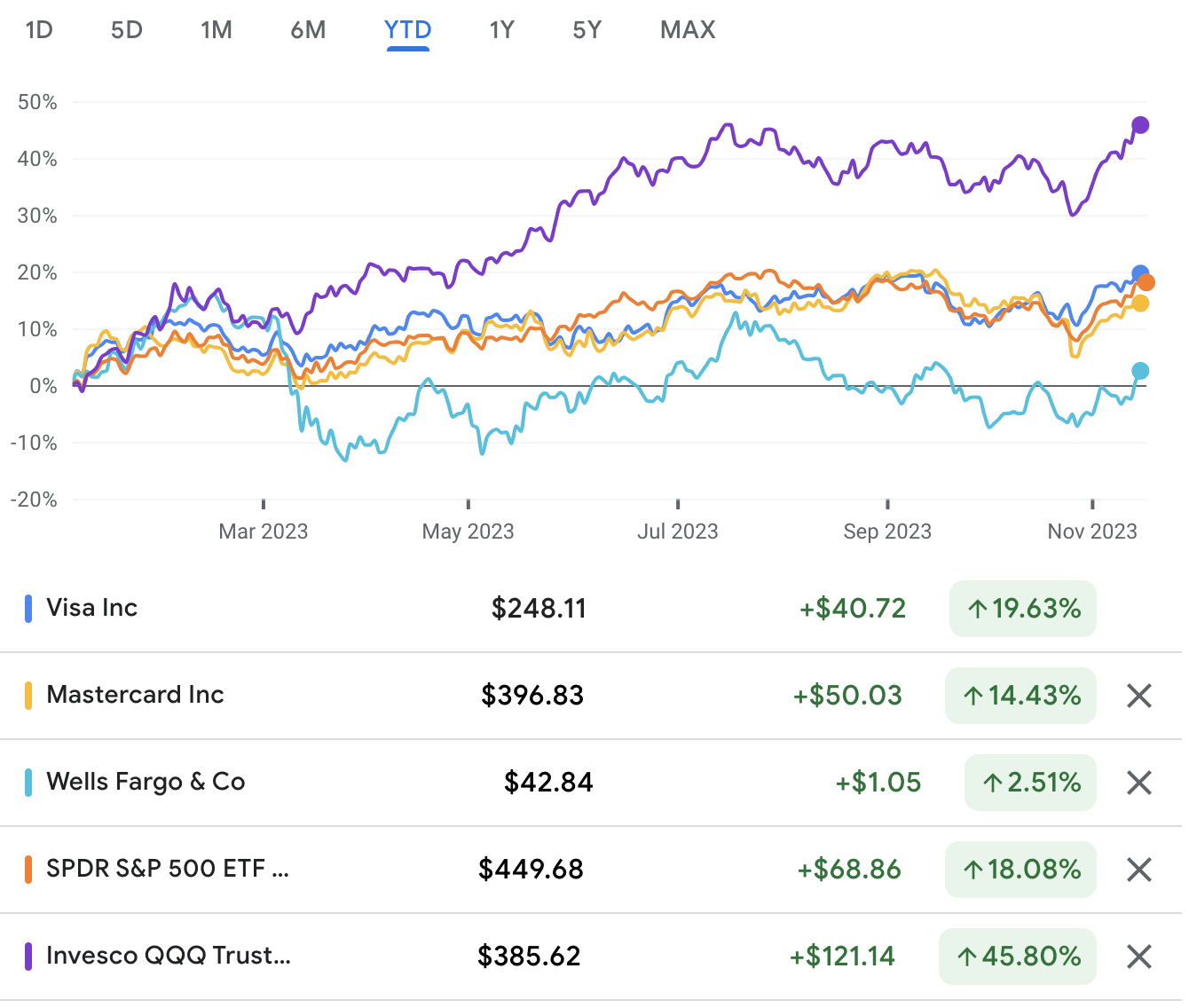

In 2023, both Visa and Mastercard performed right in line with the overall SPY, but Wells Fargo on the other hand, underwent a significant underperformance.

Companies in the finance business tend to go through cyclical seasons as they do better in a thriving economy; the reverse is also true when business activities slow down in a tougher economic environment.

The Financial sector is a huge ecosystem - from traditional banks (like JPMorgan) to insurance companies. From FinTech (like PayPal) to payment networks (like Visa). Even brokerage platforms like Interactive Brokers and Robinhood are also considered under the “Finance” umbrella.

Businesses in each sub-sector deal with vastly different business economics. We believe in focusing on those with a superior business model that can generate higher returns on investment.

Interestingly, Wells Fargo is ranked 8th, with 18 out of 78 superinvestors having a position in them.

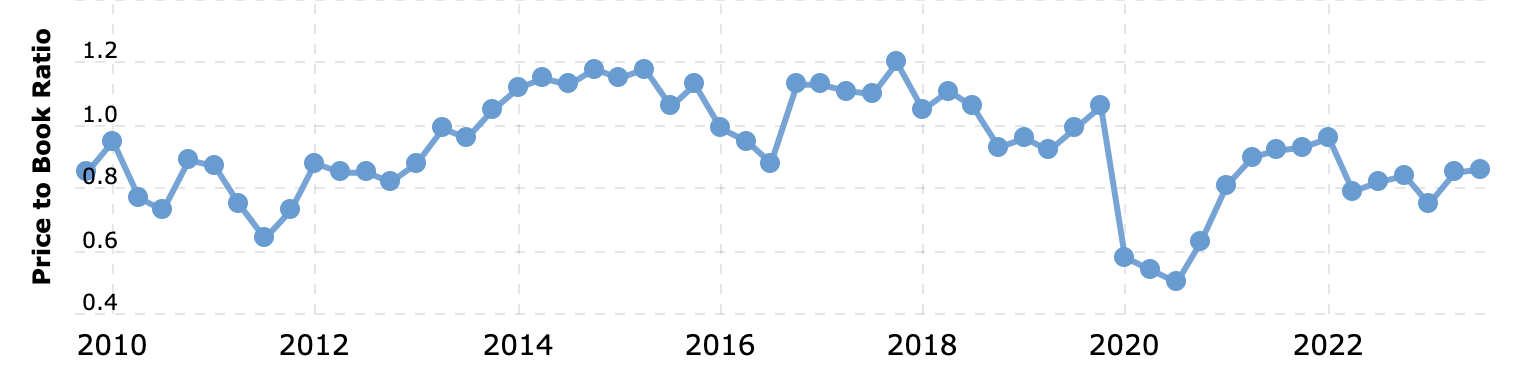

Source: Macrotrends, Wells Fargo’s P/B Ratio

When we compare Wells Fargo’s current valuation with its historical median, it does seem like it is trading at a slight discount from a Price-to-Book ratio perspective.

However, we do not deem Wells Fargo as having a deep and wide enough moat to defend from its competitors in the banking space. Furthermore, we deem banking stocks as highly cyclical in nature, and a certain level of timing the cycle is required.

On the flip side, when we look at the payment network companies like Visa and Mastercard, they’re in a totally different world when compared to the banks.

Qualities of Visa and Mastercard:

- Healthy growth trend even during tough economic environment

- Very strong return on invested capital

- Very high margins

- Little to no leverage

Therefore, Visa and Mastercard are two of our preferred stocks within the financial sector.

Berkshire Hathaway: Best Stock to Buy Now in 2023?

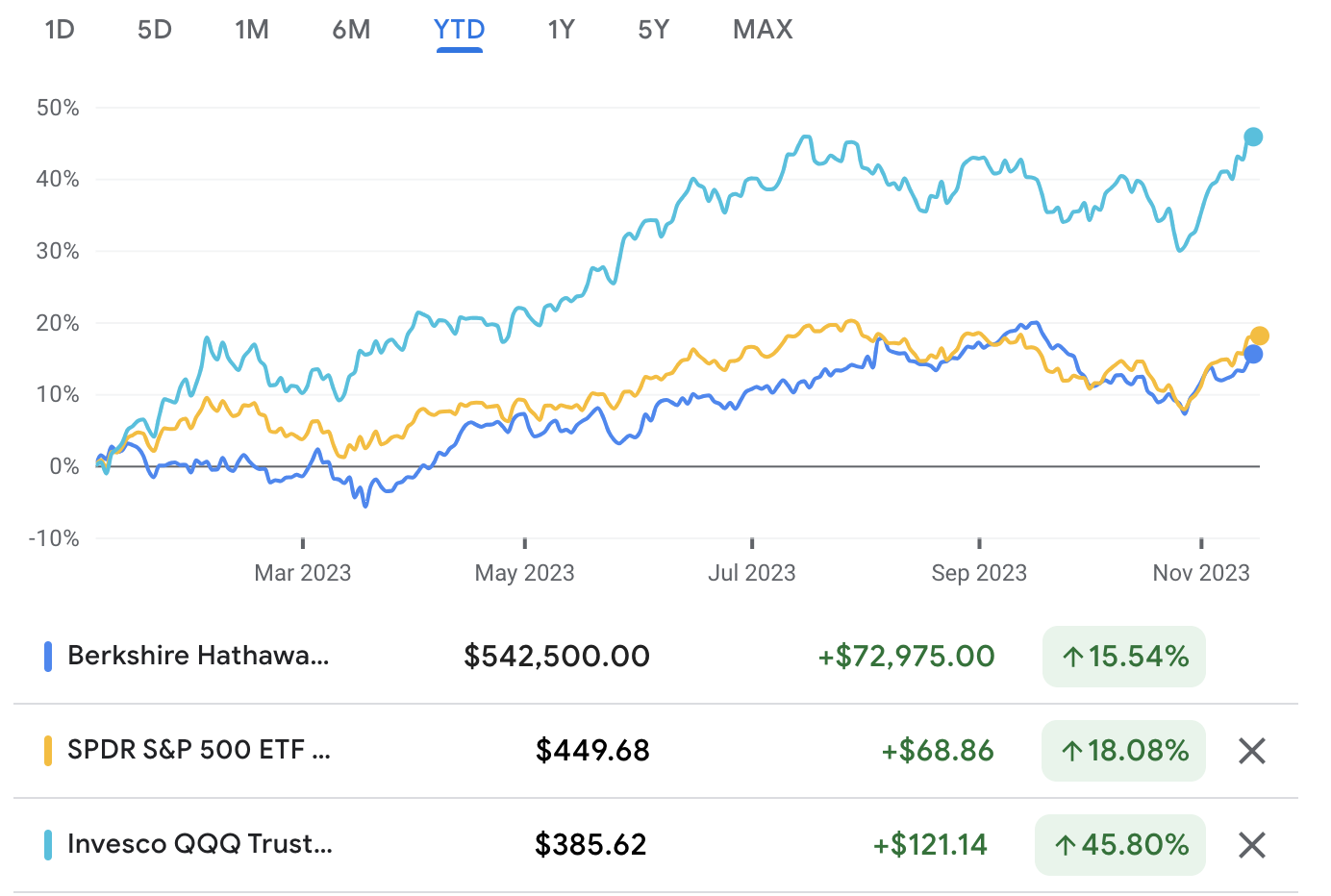

Berkshire Hathaway has managed to perform in line with the S&P 500 in 2023 so far.

Berkshire is best known for being managed by the legendary superinvestor, Warren Buffett, who managed to compound the fund at a near 20% CAGR (compound annual growth rate) for 58 years from 1965 to 2022. They own businesses in insurance, railroads, energy generation, manufacturing and retailing. More importantly, many investors follow Berkshire because they run a huge investment portfolio too, and people are interested in observing Buffett's next move.

We believe that Warren Buffett is one of the greatest investors still alive. Buying into his fund is basically picking him to be your manager that oversees your portfolio. There are however concerns around succession planning and key-man risk.

Healthcare Stocks (UnitedHealth Group): Best Stocks to Buy Now in 2023?

Similar to the financial sector, the healthcare industry is also a huge ecosystem with companies specializing in different sub-sectors (from insurance, healthcare providers, biotechnology, medical device manufacturers, to pharmaceuticals) and they each have their sector economics.

Source: Adam Khoo’s YouTube video

When comparing the ETF (exchange-traded fund) that represents the different sub-sectors of the healthcare industry, we can clearly see two outliers, namely companies in the Medical Devices & Equipment and Healthcare Providers space.

Coincidentally, UnitedHealth Group is the largest component of the IHF (Healthcare Providers ETF), with a 25.31% allocation (as of 14 November 2023).

UnitedHealth is currently the world’s largest healthcare company by revenue, and the largest insurance company by net premiums. Given its current leadership and network, it is close to impossible for a rival company to disrupt UnitedHealth’s current position.

UnitedHealth happens to also be one of the closely watched stocks at Piranha Profits, given that healthcare companies are defensive yet possess growth potential, and the quality of UNH’s fundamentals is worth paying attention to.

Many healthcare companies went under the radar in 2023 as most investors had their eyes glued on technology companies. We believe that it might present interesting opportunities to accumulate some strong healthcare names.

BONUS: What Superinvestors Have Been Buying Over the Last 6 Months

|

Stock |

Number of Buys in the Last 6 months ^ |

% of Ownership by Superinvestors Combined |

|

Walt Disney Co. |

12 |

0.03 |

|

Amazon.com Inc. |

11 |

0.17 |

|

Microsoft Corp. |

10 |

0.13 |

|

UnitedHealth Group Inc. |

10 |

0.03 |

|

Alphabet Inc. |

10 |

0.008 |

|

Charter Communications |

9 |

0.158 |

|

Fidelity National Information Services |

9 |

0.082 |

|

Visa Inc. |

9 |

0.048 |

|

JPMorgan Chase & Co. |

9 |

0.02 |

|

Meta Platforms Inc. |

8 |

0.01 |

Source: Dataroma, 6 months buy (^ sorted by Buy Count), data accurate as of 09 November 2023

On top of looking at what superinvestors are currently holding, it might be noteworthy to also see what they have accumulated over the last 6 months to form the basis of further research and potential “value buys” in today’s market climate.

A Final Note

While it is time-saving to look at what superinvestors are buying and holding, it doesn’t always mean that these are the best stocks to buy now. Different investors have different investing styles and philosophies, which might not be congruent with yours.

As Peter Lynch puts it in his book One Up on Wall Street, “This is investing, where the smart money isn’t so smart, and the dumb money isn’t really as dumb as it thinks. Dumb money is only dumb when it listens to the smart money.”

DO NOT buy into any company just because superinvestors are buying it. Always do your own research and due diligence, because conviction cannot be borrowed. Learn to analyze stocks on your own and invest based on your own judgment.

.png)

.png)

.jpg)

submit your comment