What is the best forex indicator to use? Is it MACD? RSI? Stochastics? Bollinger Bands? And the list continues… there are over 300 indicators! In this article, I'll talk about the Currency Strength Meter (CSM), the best professional forex indicator I use to generate high and consistent profits from the forex market.

| In This Article: |

Now, before you even ask which is the best forex indicator to use, you must first have a basic idea of how most professionals trade based on price action and price structure.

Basics of Trading Forex

If you ask most professional traders, they'll tell you that there are generally three ways you can enter a trade — you either trade retracements on a trend, trade breakouts, or trade reversals. Let’s review the first two, which are more widely used.

1. Trading Trend Retracements in Forex

Remember that when you look at currency pairs, there are times they move in a very strong trend, either on an uptrend or on a downtrend. You always want to follow the trend. You want to buy the currency on the uptrend and sell on the downtrend.

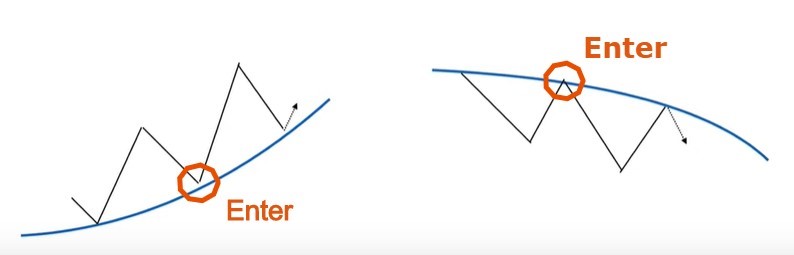

On a trend, the best time to enter is during a retracement or a correction as you can see in the illustrations above. Professional traders will tell you to go long on the retracements and go short on the corrections.

2. Trading Breakouts in Forex

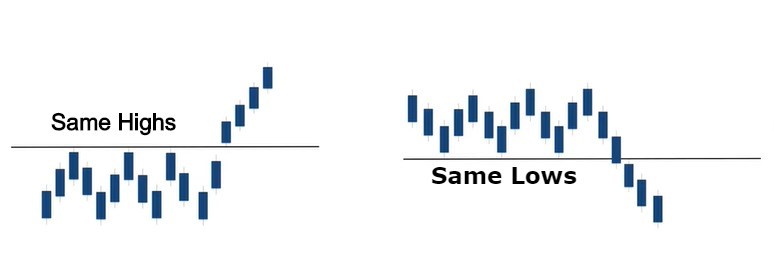

Another way to trade is during breakouts of consolidation. This is when prices are moving sideways and making same highs. When it breaks the consolidation, we enter on the breakout to capture the new uptrend. The opposite case would be when prices are making the same lows and then it breaks the support — we take a short to capture the trend all the way down.

Here's what it looks like on the charts:

You can check out a more in-depth breakdown of these strategies by reading my “3 Best Ways to Trade Forex” guide.

Why Price Action Trading Does Not Always Work

Now, what I’ve covered above is what every professional trader will tell you: Trade the retracement on the trend or trade the breakouts. This is also what we call price action trading.

But I've got news for you — it is not that simple! If trading forex was that simple, everyone who takes a trading course or watches a trading tutorial would be profitable in the markets. And the truth is most people are not. Here’s why.

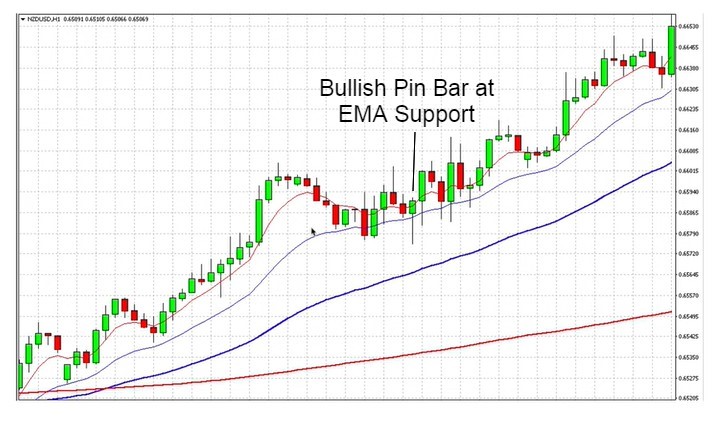

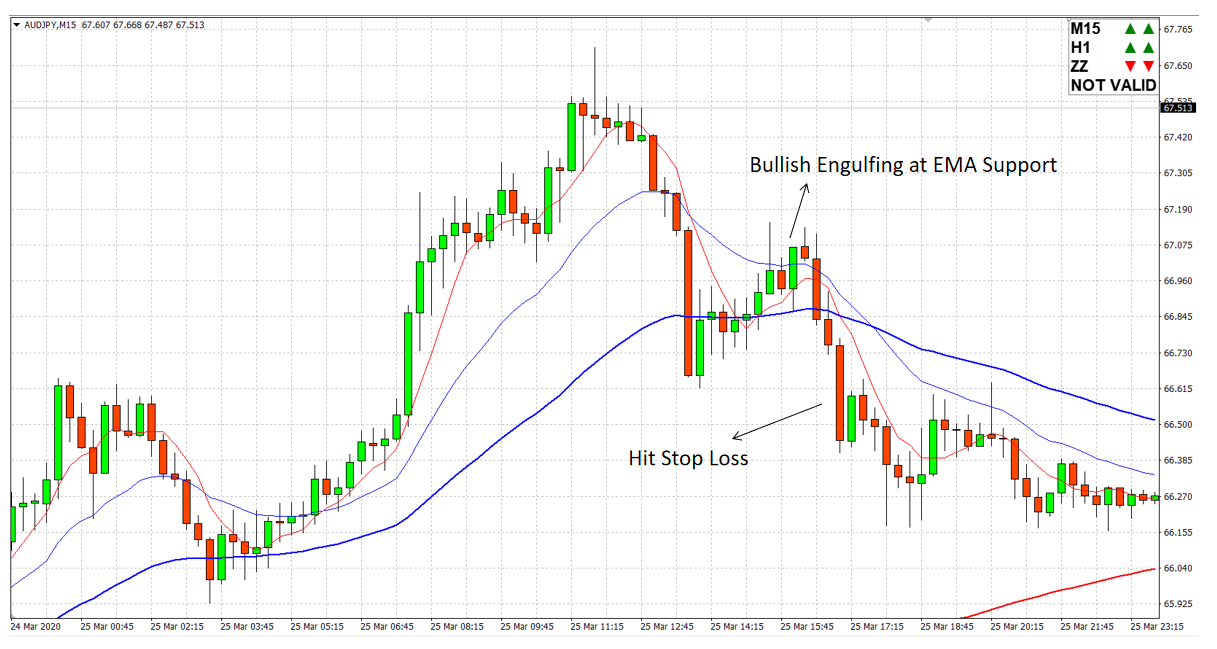

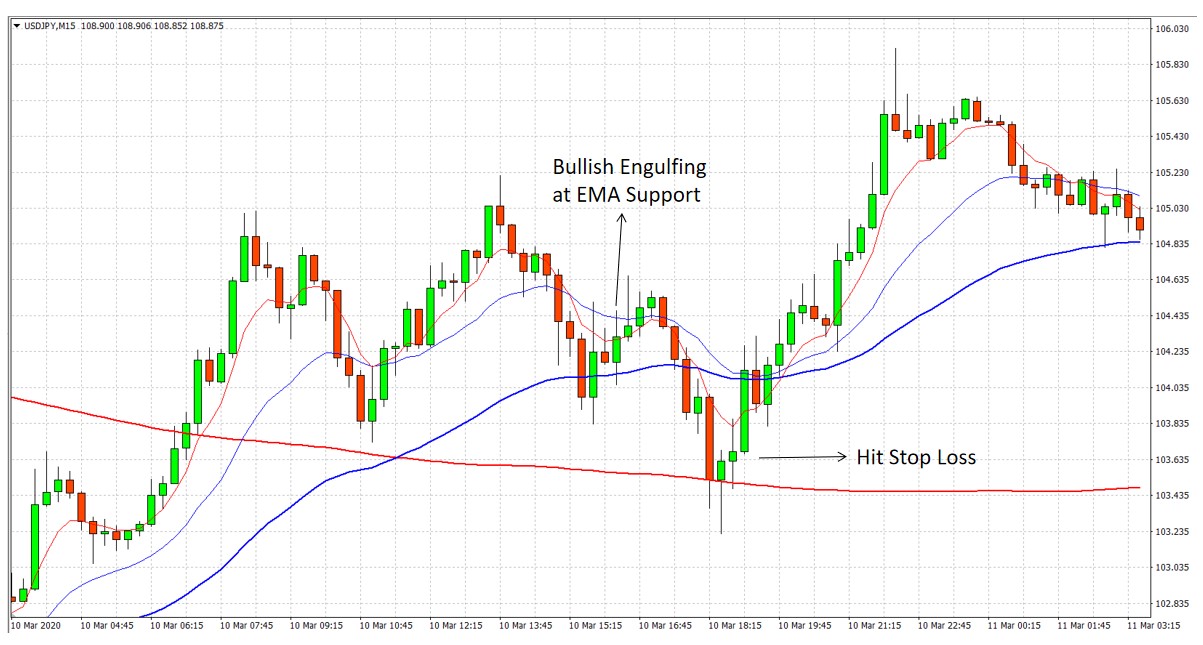

A lot of amateurs find that when they identify a trend and enter at the support after seeing a confirmation candlestick pattern, the trend changes and they get stopped out. Or they see it in a consolidation, and it breaks out with a strong candlestick pattern, they enter long, and again it reverses and they get stopped out.

Here are some examples to help you see what I mean:

This is really frustrating for beginner traders and they might even start to doubt if price action trading still works today. And the answer is OF COURSE it still works. But if that’s the case, why aren’t all Forex traders successful in making consistent profits using these strategies?

The reason is very simple: it's not good enough to only look at trends or support levels or candlestick patterns. What's important is you must look at the strength of the currency at that moment in time.

Because even if a currency is on an uptrend, even if it breaks out from a consolidation, if the currency is not strong relative to other currencies, you will find that the moment you enter, it reverses easily. This significantly reduces your win rate so most people who start price action trading end up losing money.

Now, let me introduce you to the best forex indicator I use to identify the strength of a currency at any point in time — the CSM.

The Best Forex Indicator: Currency Strength Meter

What is a Currency Strength Meter? It is one of the most powerful indicators used by professional bank traders to identify the strength of a currency compared to other currencies. It is also my secret weapon for getting consistent forex profits.

With this professional forex indicator, we can tell how strong each currency is so that we can always buy the strongest currencies and at the same time sell the weakest currencies. That's what gives us the strongest edge in the forex market.

Let me show you how it works right now.

How to Read the Currency Strength Meter

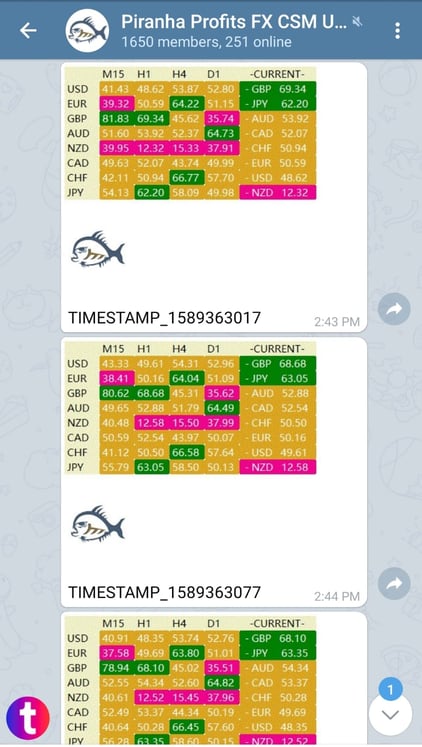

Here’s a snapshot of the exclusive CSM given in my Pip Fisher™ forex trading course.

Look at all these numbers in the table. Whenever a currency has a value of 60 and above, it's considered a strong currency. These are coded in green. And if a currency has a value below 40, it's a weak currency and it's coded in pink. The ones in yellow are neither strong nor weak, they're neutral. These are the ones we want to avoid. We only want to buy the green ones and sell the pink ones.

Now, you can see that some currencies are strong and weak on different timeframes, i.e. 15-minute, 1-hour, 4-hour and 1-day. So it depends on which timeframe you're trading at. There's no perfect timeframe as different traders like to trade on different timeframes. I like to trade on the 15-minute, 1-hour and 4-hour timeframes most of the time.

Let’s look at the H4 timeframe for example. We can see what are the strong currencies — the USD is green so it's strong, same for the JPY. What's weak? The AUD as it is pink. So, how do I know which pairs to look at when I’m looking for trend retracements or breakouts to trade? I always match a green with a red on the CSM. So in this case, I can look at the AUDUSD and AUDJPY.

How to Trade Forex Using the CSM

Now, here’s what you DO NOT want to do: do not ever trade two currencies that are strong or weak at the same time. For example, based on the CSM’s indications at that time, it'd be really silly to trade the USDJPY. Why? Because USD is green and JPY is green as well. They're both strong currencies so whether you go long or short, it's not gonna go clearly in one direction. The two strong currencies will fight against each other!

At the same time, looking at the H1 timeframe on the CSM, it’s not a good idea to trade the CADCHF or the GBPAUD, because they're both pink. Since they're both weak currencies, it's not gonna go very clearly in one direction. Again, always buy the green currencies and sell the red currencies. And do it when you see a retracement on the trend or breakout from the consolidation.

When you combine the CSM with price action trading, it becomes a very powerful forex strategy to achieve high returns and win rate in your trading.

What makes the CSM the Best Forex Indicator?

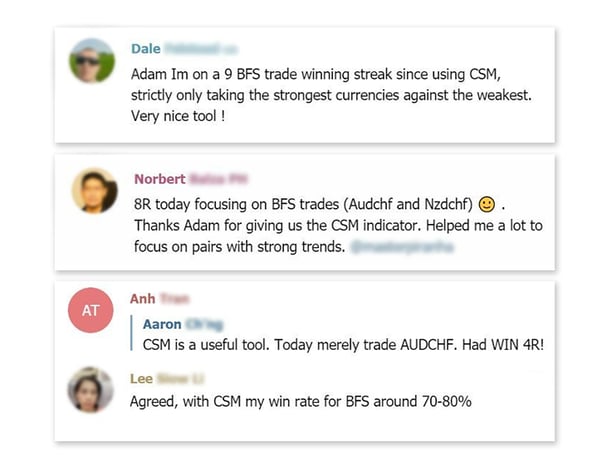

Let’s now take a little peek into my Telegram chat group community (over 1,100 members at the time of this article) to see how the CSM has been working for my students.

As you can see, my student Dale was able to achieve a 9-trade winning streak by strictly trading the strongest currencies against the weakest (this was done using the Bull Flag Surf (BFS) forex strategy which I teach in my Pip Fisher™ forex trading course).

Another student, Siow Li, was able to bring her win rate to an impressive 70 – 80% by using the CSM. Isn’t this amazing?

These results and reviews from real-life forex traders go to show that the CSM is a highly powerful indicator that can massively improve our win rate when combined with a proven forex strategy!

How to Get the Currency Strength Meter

The CSM is a bonus indicator given to my students when you enrol in my Pip Fisher forex trading course.

You will be given access to our exclusive one-way Telegram channel that automatically posts minute-by-minute snapshots of major currencies and their relative strength.

All you need to do is check this tool and instantly know which are the best currency pairs to trade at any point in time!

In this course, you’ll also learn powerful forex strategies such as the Bull Flag Surf that complements powerfully with the CSM for consistent profits.

submit your comment