Whenever I tell people that the way I generate income is by trading the stock markets, they look at me funnily and go, “Hey, isn't that gambling? Doesn't that depend on luck? Isn't that risky?”

Does Trading = Gambling?

And I'm here to tell you the honest truth — trading is gambling, absolutely! The stock market is like a giant, legal casino.

Let me ask you this: In gambling, who always loses money? The answer is the players. You see, as a player, you may have a winning or losing streak in the short term based on luck. But luck doesn't last forever. Luck run outs eventually and players lose everything they have.

But who always makes money in the end? That’s right, it’s the casino.

I'm sure you've heard this saying, “The house always wins.” Why else would the casino give away free food, drinks and entertainment just to attract people to play? It’s because the more people play, the more money the casino makes.

But how can a casino ensure that in a game of chance they always make money? Similarly, how can a trader ensure consistent profits in the unpredictable stock markets?

Read on as I reveal the secret of the casinos and how I make my income as a professional trader by trading just like one.

Why Casinos Always Win: Decoding Their Edge

So how do casinos guarantee that they always make money in the end? Well, what they do is they rig the game in a way that gives them a statistical edge over the market.

In other words, they've got a positive expectancy while the players have negative expectancy. Sounds technical? Let me give you an example.

The Roulette Rig

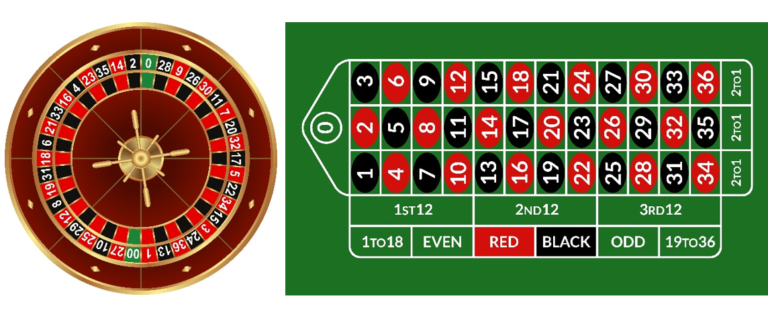

Let's take this simple game called “roulette”. In roulette, you've got a giant wheel with 18 red numbers and 18 black numbers in alternate order.

You've also got this spinning device; you throw the ball in and it lands on one of the numbers. You can bet what kind of number it lands on, like odd or even, black or red, or you can bet on a specific number.

Now, here's the thing: Many people think that if they bet on a colour, like black, they've got a 50-50 chance of being right.

Well, they’ll be sad to hear this. It is not a 50-50 chance because the casino has rigged the game — they added two green numbers, the 0 and 00, on each side of the wheel.

Therein lies their secret.

For example, if you bet on black, what's your chance of being right? Your chance is not 18 out of 36, but it’s 18 out of 38, because there’s two extra green numbers, remember? So the casino wins if the ball lands on a red or green number.

If we work out the probability:

- Player’s chance of winning = 18 / 38 x 100 ≈ 47.3%

- Casino's chance of winning = 20 / 38 x 100 ≈ 52.7%

- Take 52.7 minus 47.3 and the casino gets a 5.4% edge over the players.

Now, what does this 5.4% edge mean?

It means that in the long run, over many bets, for every $1 that people bet, the casino will make 5.4% of their money, which is 5.4 cents. If a million dollars are bet, the casino will make on average $54,000.

Let me explain this another way.

Imagine there are 1,000 bets and each bet is $1,000, so a total of $1 million is being bet. Statistically, out of 1,000 bets, the casino will win 527 bets and lose 473 bets. Since each bet is $1,000, they earn $527,000 but lose back $473,000. There you have it — their net profit is $54,000 (5.4%).

So the more people gamble and the more money they bet, the more money the casino makes. That's how they always win at the end of the day.

Why Most Traders Lose in the Stock Market

90% of people who trade stocks will lose money just like the players who go to a casino.

The reason is simple: They dive headfirst with no plan, no strategy. They buy based on rumors, emotions, opinions, tips.

To make things worse, most traders fall prey to 3 deadly emotions, so they lose more when they are wrong and make less when they are right.

Let me give you some examples.

How Traders Make Losing Trades Due to Their Emotions

Say, this trader buys a stock at $10, thinking “It's gonna go up, yes, I believe it’ll go up.”

But it doesn't. It goes down, and the trader tells himself, “It'll come back tomorrow. It’ll surely come back,” and he keeps holding on to it till he gets a big fat loss.

On the other hand, if the stock goes up by a bit to $11, the trader will say “Oh, I’ve made some money. Let me take my profits before I lose it.” And he takes a small profit.

For most people, the moment they make a bit of money, they want to sell and take it out of the market. This need for instant gratification causes tiny profits, while the fear of losing money causes people to hold on to their losses and lose big.

That’s why in the long run, they lose more than they earn.

How Professional Traders Trade and Profit Like Casinos

Professional traders always make money at the end of the day. Not by magic or sheer luck, but by replicating the business model of the casino.

I explained how casinos rig the game to gain a statistical edge over the players, right? Now let me show you how professional traders rig the stock market (legally, of course ?).

When most traders buy or sell a stock, they see it as a random 50-50 chance — the market either goes up or down.

But what professional traders do is we study the markets, look for repeatable price action patterns and apply technical analysis to enter when the statistical edge is in our favor.

Let me give some examples.

In a stock market, three things can happen: the market either goes on an uptrend, sideways, or a downtrend. In this article, I’ll focus on the first two.

How Professional Traders Trade an Uptrend

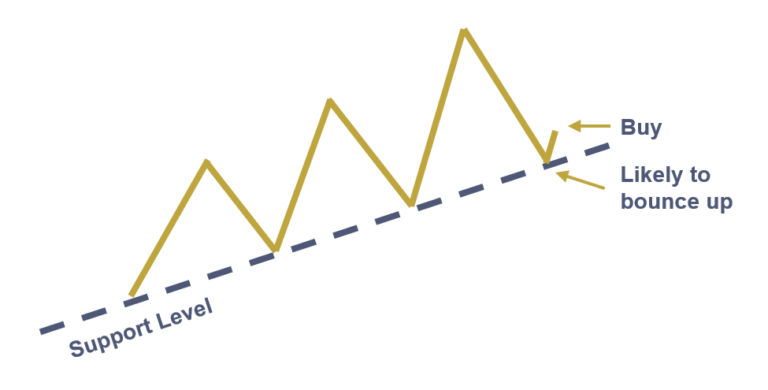

If a stock is on an uptrend, you’ll notice that it doesn't go up in a straight line — it goes up, down, up, down, up.

And often, when it corrects to a support level, you see this very repeatable wave pattern, and when it hits the support level again, it’s likely to bounce back up.

So as professional traders, that's when we buy because on an uptrend, when the price hits a support level after retracement, there’s a high probability that it will go up.

Now, is this guaranteed? Is it 100% gonna go up? Of course not. It could still go down. But when you enter at this repeatable price pattern, the chance of it going up is more than a random 50%.

Let’s say there’s a 60% chance it'll go up, and a 40% chance it’ll reverse into a downtrend. You’ll win 60% of the time and lose 40% of the time, giving you a statistical edge of 20%.

Even if you are only right 55% of the time, you still get a 10% edge! So being a professional trader is better than owning a casino, if you think about it that way.

How Professional Traders Trade a Sideways Trend

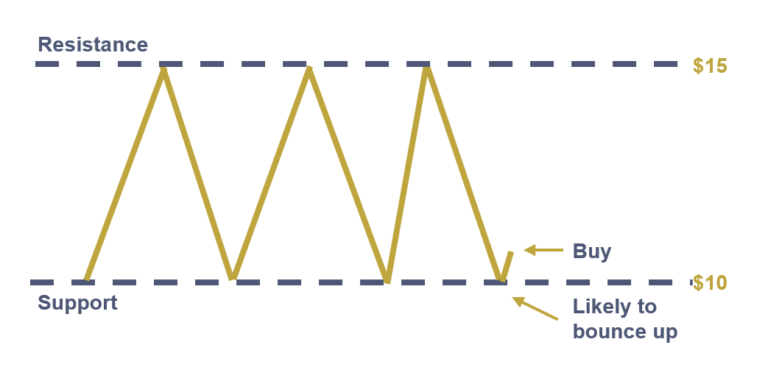

Usually when a market goes sideways, it's within a range capped by the support and resistance levels.

We only trade when we see a repeatable price pattern such as this. We know that the next time the price bounces off the support again, it is likely to bounce back up.

But is the price guaranteed to go up?

No, it's just a probability. But based on its repeatable price pattern, the chance of it going up is say, 60% and the chance of it going down is 40%.

How Professional Traders Trade a Dollar to Win Two…Or More

Here's the best part:

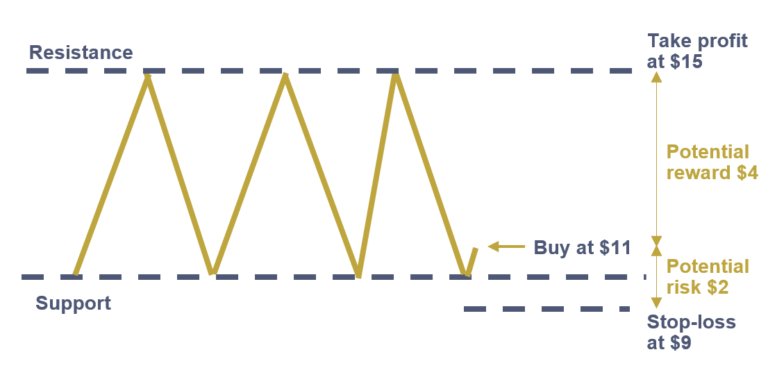

As a player in the casino, you usually bet one for one, right? If you bet $100 and you lose, you lose $100. If you win, you win $100. But in professional trading, we never bet one for one, we always bet at least one for two.

In other words, we always risk $1 to make $2 or more. How do we make this happen? By placing a stop-loss to guarantee how much we'll lose if we’re wrong, and a profit target to guarantee how much we'll win if we're right.

Let’s use the previous example.

Say you buy the stock at $11. You place a stop-loss order at $9, which means if the price goes to $9, the system sells it immediately and cuts your losses.

If you do this, how much will you lose when you're wrong? $2. Now you just have to make sure the distance from your entry price to your exit price is more than this $2.

Let’s say you sell at the top of the range, which is $15. How much will you make? You make $4. So you're risking $2 to make $4.

In other words, you're risking one to make two; you're trading 1:2 with a 60% win rate. And this is how we rig the game of the stock market.

How Professional Traders Always Win in the Long Run

Now, if you maintain a risk-reward ratio of 1:2 in the long run, what happens? Let’s look at 100 trades, for example.

(I do 20 trades a month on average, so it takes me about 5 months to do 100 trades.)

Again, let’s say my win rate is 60%. Out of 100 trades, I’ll win 60 trades and lose 40 trades. Each time I lose, I lose $1. But each time I win, I win at least $2.

So my overall outcome is:

$2 win x 60 trades = $120 win

$1 loss x 40 trades = $40 loss

$120 - $40 = $80 profit

You see, whenever I make a trade, I've got no idea whether it'll be a win or loss (no one can predict the market!)

In the short term, I may have a losing streak or winning streak. But over 100 trades, for example, I know I always win because of the statistics being in my favor.

In other words, if I'm “betting” $1 per trade over 100 trades, I'm getting $80 back. That's a nice 80% return in trading profits!

Now, of course, there's no guarantee that you're going to have a 60% win rate. What if the worst case scenario happens, you get a string of bad luck and your win rate goes down to 50%?

$2 win x 50 trades = $100 win

$1 loss x 50 trades =$50 loss

$100 - $50 = $50 profit

Guess what? Because of the way we rig the market with the risk-reward ratio, we still make 50% return in the end.

This, my friend, is the essence of how professional traders trade the stock market, so we always make money consistently at the end of the day and this is how we grow our income and wealth.

Want to learn how to make consistent profits like a professional trader? Watch my free course here.

submit your comment