Whether you’re an investor or trader, options are a great tool that allows you to profit under most if not all market conditions, be it bullish, bearish, or even when the market moves sideways.

In this beginner options trading guide, you’ll learn about:

- Calls, puts, strike prices, premiums, and expiration dates

- Buying and selling calls & puts in bullish and bearish markets

- Five options greeks and how they affect options premiums

- Four basic options trading strategies

- Risks of trading options

- Benefits of options trading for traders and investors

Table of Contents:

I. Understanding Options Trading for Beginners

II. Buying Options: Calls and Puts

III. Selling Options: Calls and Puts

V. Intrinsic Value of Calls and Puts

VI. Understanding Option Greeks

VII. Options Trading Strategies for Beginners

• Strategy 1: Long Calls & Long Puts

• Strategy 3: Cash-Secured Puts

• Strategy 4: Bull Call Spread

VIII. Options Trading Risks and Considerations

What Is Options Trading?

As a beginner, options trading might initially sound pretty intimidating, especially if you have zero knowledge of trading or investing. So let’s break it down into simpler terms.

Imagine that you’re making a deal with someone to buy or sell something in the future at a set price. That’s essentially what options trading is all about.

Making Deals for the Future

When you trade options, you’re making agreements to potentially buy or sell an asset, like a stock, at a specific price (called the “Strike Price”), but not immediately. If you’re the party that’s buying the options contract, you have the option to follow through with the deal, but you’re not obligated to do so.

“Betting” on Price Changes

Options trading allows you to speculate on how the price of an asset will change over time. If you think a stock will go up in value, you could buy a call option now to be able to purchase the stock at a lower price in the future. On the other hand, if you think a stock will decrease in value, you might consider buying a put option to be able to sell the stock at a higher price in the future.

Limited Risk, Potentially High Rewards

One of the pros of options trading is that it gives the potential for big gains with a relatively small investment. Depending on the options strategy you use, you can also predefine your risk, so that you control the maximum amount of money you can lose no matter how badly the price goes against you.

Why Trade Options?

Options Trading Benefits for Investors

If you’re a long-term stock investor, you’d know that if you simply bought the S&P 500 index ETF, in the long run, you would get on average an 8% to 10% return a year.

If you invested in fundamentally good companies that beat the index and bought them when they’re undervalued, over the long run you’d be getting somewhere between 15% to 20% return a year on average.

But with options, you’ll be able to turbocharge your portfolio returns by up to 36%, or even 60% a year! And the best part is that you can boost your returns while lowering the risk of your portfolio.

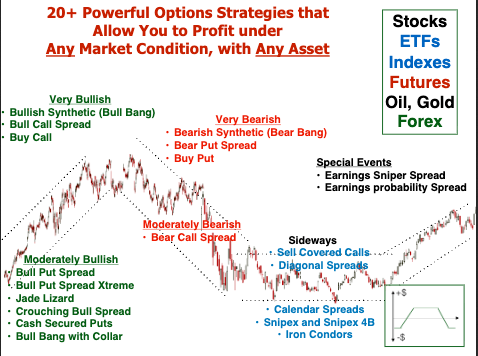

Using Stock Options to Profit in Any Market Direction

Chart by Piranha Profits Team

One of the biggest advantages of options trading is that you can profit in any market direction up, down, or even sideways. Traditional stock traders only make money when prices rise.

Options traders, on the other hand, can structure trades that benefit from movement, stagnation, or even volatility itself. This flexibility is what makes options such a dynamic tool.

Think of options strategies as two different games: one plays the movement, the other plays the clock. The first is directional trading, the second is non-directional trading.

Directional Options Trading

When you have a clear bias on where the market is heading, bullish or bearish. You can build a position that benefits from that movement using a fraction of the capital you’d need to buy shares outright.

For example, instead of buying 100 shares of a $100 stock (which costs $10,000), you could buy a call option for maybe $300.

If the stock rises, your option’s value can increase significantly, giving you a much higher percentage return with your loss limited to what you paid.

Non-Directional Options Trading

Even when the market refuses to pick a direction, options traders can still profit.

Non-directional trading focuses on time decay and volatility management — earning consistent income when prices move less than expected.

These setups, often called neutral or income strategies, involve selling option spreads or combinations that benefit when the market stays range-bound. As time passes and options lose value, the trader collects the remaining premium.

This is the quiet strength of options: the ability to get paid for simply being right about nothing happening.

Calls and Puts – What are they?

Before you get too excited and pull up your favorite stock’s options chain, it’s worth understanding what calls and puts actually are. Once you grasp these two building blocks, that complicated-looking table suddenly makes sense every price, strike, and expiry becomes clear.

Call Option Definition and Analogy

A call option gives the buyer the right to buy a specific quantity of the underlying stock at the strike price before the expiration date. If the stock price rises above the strike price before expiration, the call option holder can exercise their right to buy the stock at the lower strike price, potentially making a profit.

Imagine you’ve found a bike you like, but you’re not ready to buy it outright. Instead, you pay $15 to rent the option to buy that bike for $100 anytime within the next month.

During that month, the bike’s market value jumped to $150. Because you hold the option, you still have the right to buy it for $100, even though everyone else must pay the new higher price.

Here’s the math:

Total spent: $15 (option rental, or “premium”) + $100 (purchase price) = $115

Market value of the bike: $150

You’ve effectively paid $115 for something now worth $150, locking in a $35 profit all because you controlled the purchase with an option instead of buying outright.

Put Option Definition and Analogy

A put option is the opposite. It gives the buyer the right to sell a specific quantity of the underlying stock at the strike price before the expiration date. If the stock price falls below the strike price before expiration, the put option holder can exercise their right to sell the stock at the higher strike price, potentially profiting from the price decline.

This time, you pay $5 to rent the option to sell the bike at a fixed price of $100, valid for one month. During that month, the bike’s market value drops to $80. Thanks to your option, you still have the right to sell it for $100, even though it’s now worth less.

Here’s the math:

Bike sold for: $100

Premium paid for the option: $5

Potential loss without the option: −$20 (if sold at $80)

Actual loss: only −$5, the premium you paid

In both cases, you pay a small fee upfront for control — the right, but not the obligation, to act later. If you don’t exercise your option before it expires, you simply lose that fee, much like forfeiting a rental deposit.

I. Understanding Options Trading for Beginners

.jpg?width=4800&height=1636&name=Options%20Contract%20Example%20MSFT%20Dec%20200%20Call%20at%20$8%20(1).jpg)

The diagram above is an example of what an options contract typically looks like. So let’s break down what it means:

MSFT = Stock Ticker Symbol

Dec = Expiration Date

200 = Strike Price

Call = Options Contract Type

$8 = Cost of the Premium per share

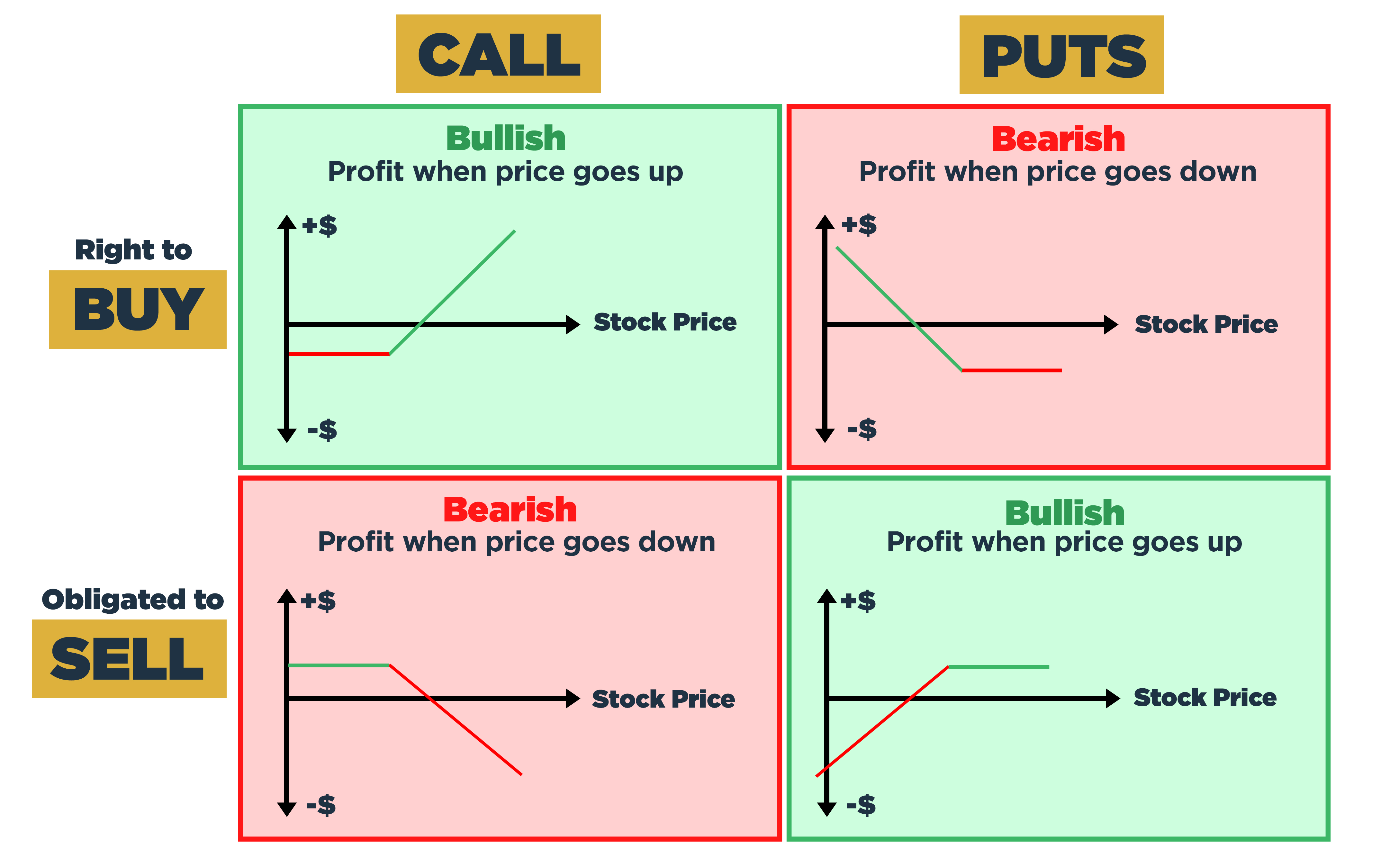

In the market, you can play one of two roles. You can either be an options buyer, or an options seller (writer). There are two types of options: calls and puts.

So you're able to:

- Buy calls

- Buy puts

- Sell calls

- Sell puts

Let’s dive into what these terms mean, shall we?

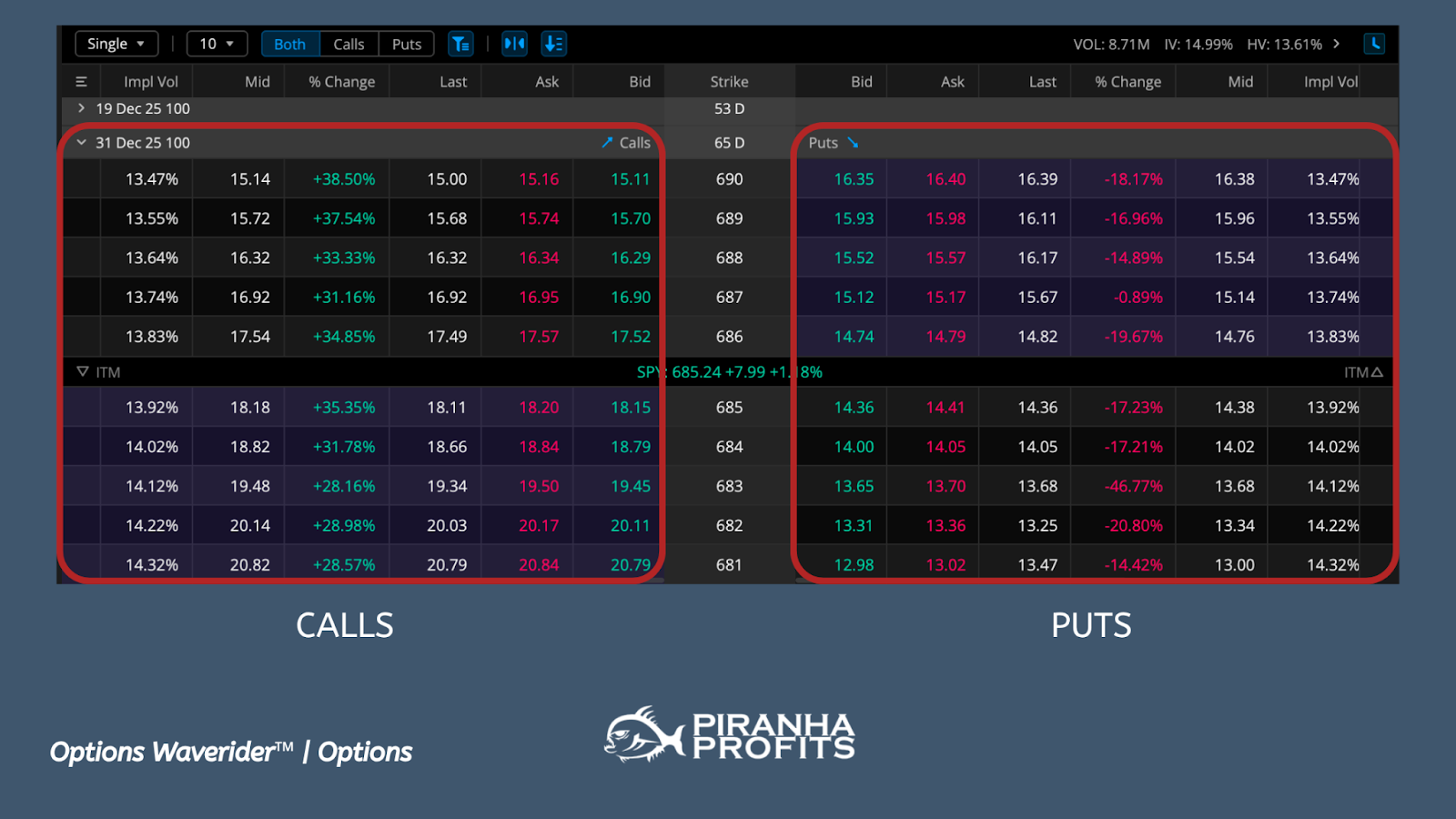

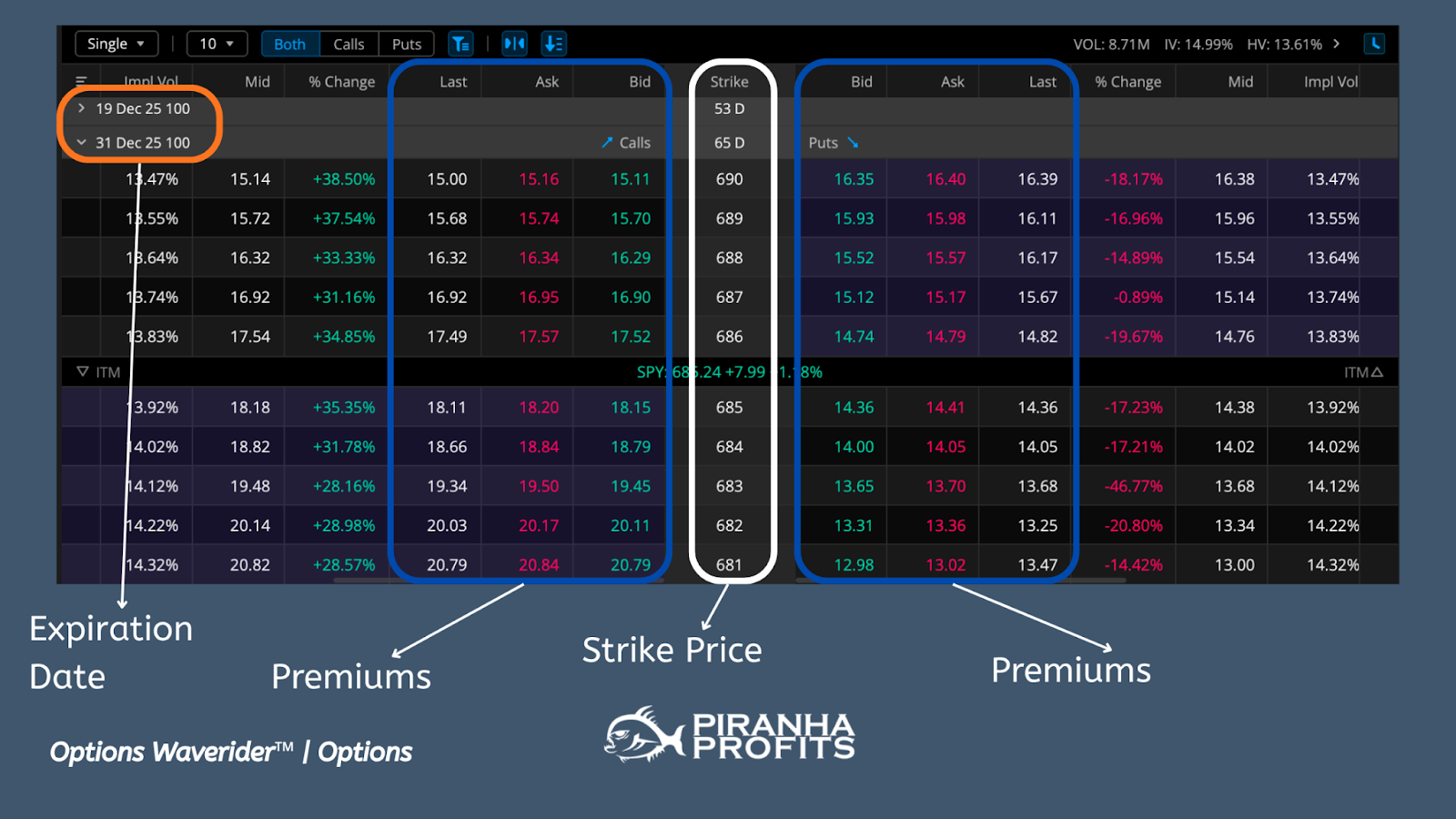

Key Terminologies and Example of an Options Chain Table

Call Options

When you buy a call option, you’re buying a contract that gives you the right to buy 100 shares of stock at a pre-agreed price, which we call the strike price, on or before an expiration date.

When you buy a call option, you have to pay a premium upfront. When you sell (write) a call option, you receive a premium upfront instead.

Buying a call option means that you expect the price to go up.

Selling a call option would mean that you expect the price to go down.

Put Options

Buying a put option contract gives you the right to sell 100 shares of a stock at the strike price before a specific expiration date.

Just like buying a call option, you will have to pay a premium upfront when you buy a put option. When you sell (write) a put option, you receive a premium upfront instead.

Buying a put option means that you expect the price to go down.

Selling a put option means that you expect the price to go up.

Strike Price

The strike price, also known as the exercise price, is the pre-agreed price at which the holders of an option can buy or sell the underlying asset if they choose to exercise the option.

The strike price is always specified in the option contract.

Expiration Date

The expiration date is the date on which an option contract expires and becomes worthless. After the expiration date, the holder of the option no longer has the right to buy or sell the underlying asset (stock) at the strike price.

Premium

The premium is the price paid by the buyer of an option contract to the seller. It represents the cost of purchasing the option contract and is determined by various factors, including the current price of the underlying asset, the strike price, and the time remaining until expiration.

Contract Size for Options

Each standard options contract for stocks represents 100 shares of the underlying stock. So, a premium of $15.00 means the total value of that contract is $1,500.

1 Contract is Equal to …

|

For Stock/ETF/Index |

100 Shares |

|

For Crude Oil |

1000 Barrels |

|

For Natural Gas |

10,000 MMBtu |

|

For Gold |

100 Ounces |

|

E-mini S&P500 Futures (/es) |

50 Futures |

Stocks versus Options: What Sets Them Apart?

A common question people ask is this: “Do I have to own the shares to sell calls or puts?

The short answer is, no you don’t have to own the shares. What we do is either buy the options or sell the options.

| ASPECT | STOCKS | OPTIONS |

| Ownership Vs. Rights | Buying shares means owning part of a company, with voting rights and potential dividends | Options contracts give you the right to buy or sell an asset at a set price but do not grant ownership. |

| Cost and Leverage | Require full payment per share | Priced lower, allowing control of assets for less capital, with the potential for amplified returns or losses due to leverage. |

| Risk and Reward | The potential loss is limited to the investment amount while offering huge return potential. | Buying options limits loss to the premium paid with high return potential while selling options can expose you to unlimited risk with limited return potential. |

| Time Sensitivity | No expiration date; can be held indefinitely | Have expiration dates, becoming worthless after. Influenced by factors such as time decay and volatility. |

If you prefer learning through videos, you can watch the full lesson here:

II. Buying Options: Calls and Puts

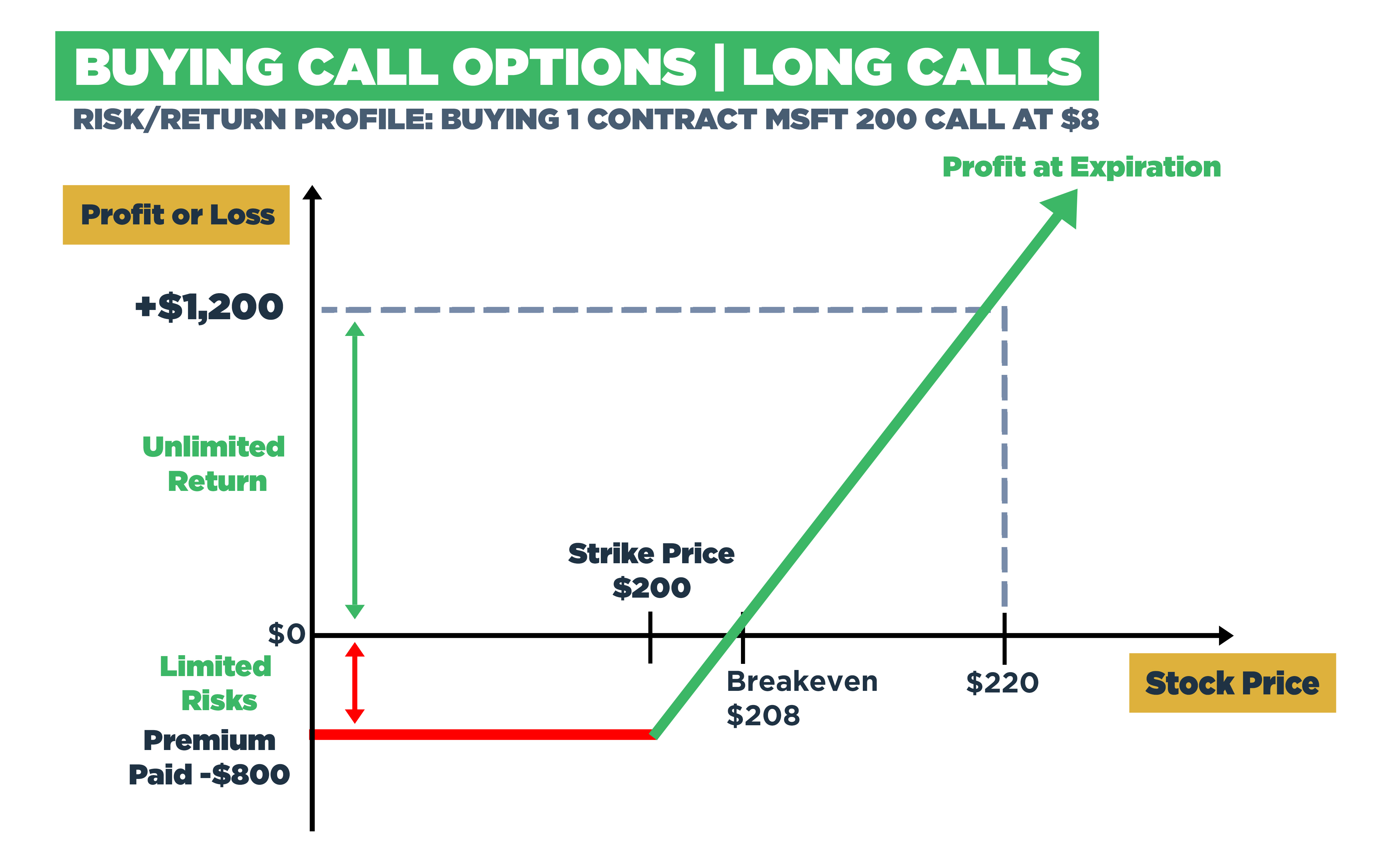

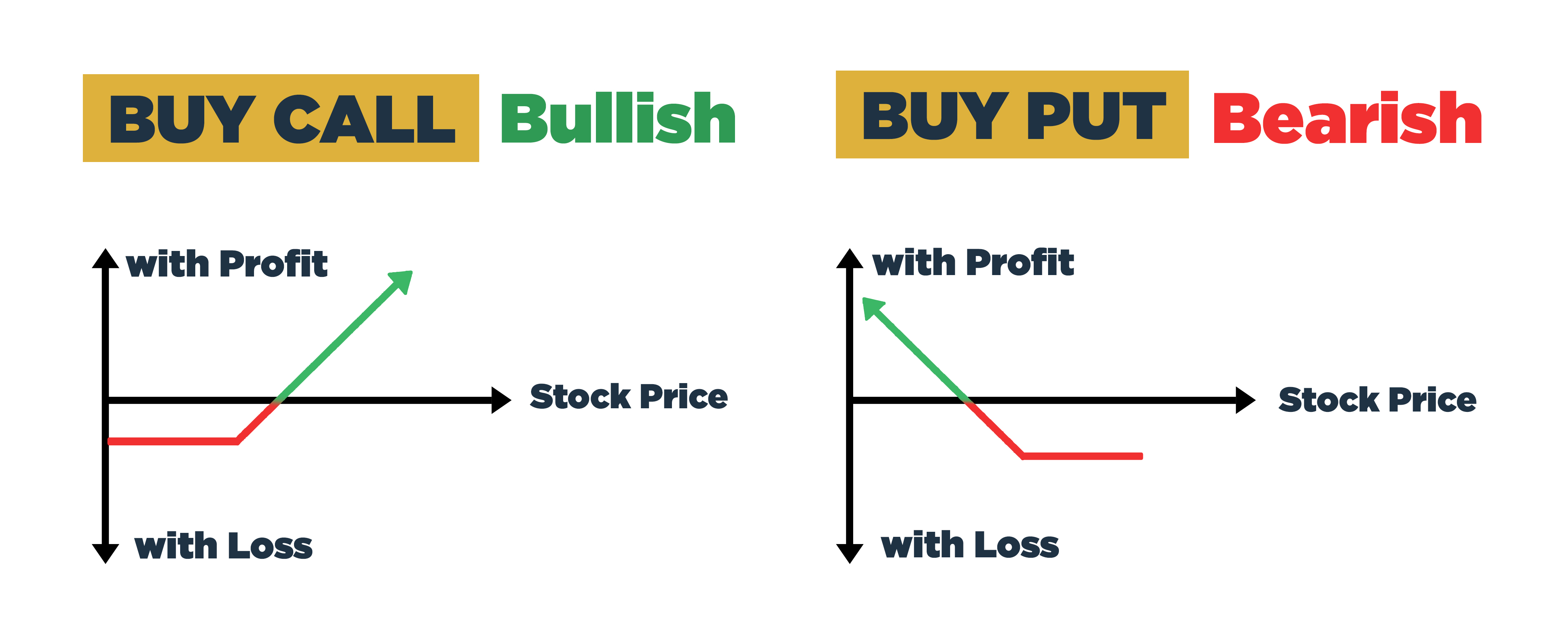

Buying Call Options

Buying a call option gives you the right (but not the obligation) to buy the underlying asset at a specified price (strike price) within a certain timeframe (until expiration).

Example: Buying Call Options

Let’s say you’re bullish on Microsoft [MSFT] stock, and let’s assume they’re currently trading at $200 per share. You believe that the stock price will rise in the next month.

So you decide to buy a call option for Microsoft with a strike price of $200 and an expiration date of one month. You pay a premium of $8 per share for the option.

If, by the expiration date, the price of Microsoft’s stock rises above $208 (strike price of $200 + premium of $8), you can exercise your call option.

For instance, if the stock price rises to $220 per share, you can buy shares at $200 per share (the strike price) and sell them at $220 per share, earning a profit of $12 per share ($220 - $200 - $8). For each contract that you buy (1 contract minimum, 1 contract = 100 shares), your total profit would be $1200.

But if Microsoft’s stock price didn’t increase as you anticipated or didn't rise above the strike price by the expiration date, the call option would expire worthless, and you would lose the premium you had paid of $8 per share, costing you a total of $800.

Profit Potential

When you buy a call option, your potential profit is unlimited.

If the price of the underlying asset goes up significantly before the option expires, you can exercise the option and buy the asset at the lower strike price, then sell it at the higher market price for a profit. Your profit is the difference between the market price and the strike price, minus the premium you paid for the option.

Call option buyers are bullish on the market. They profit when the stock price goes up.

Risks of Buying Call Options

The main risk of buying a call option comes when the price of the underlying asset doesn't rise as expected or doesn't rise enough to cover the cost of the premium. In this case, the option could expire worthless, and you would lose the entire premium paid.

Additionally, because options have expiration dates, time decay can erode the value of the option if the price of the underlying asset doesn't move quickly enough.

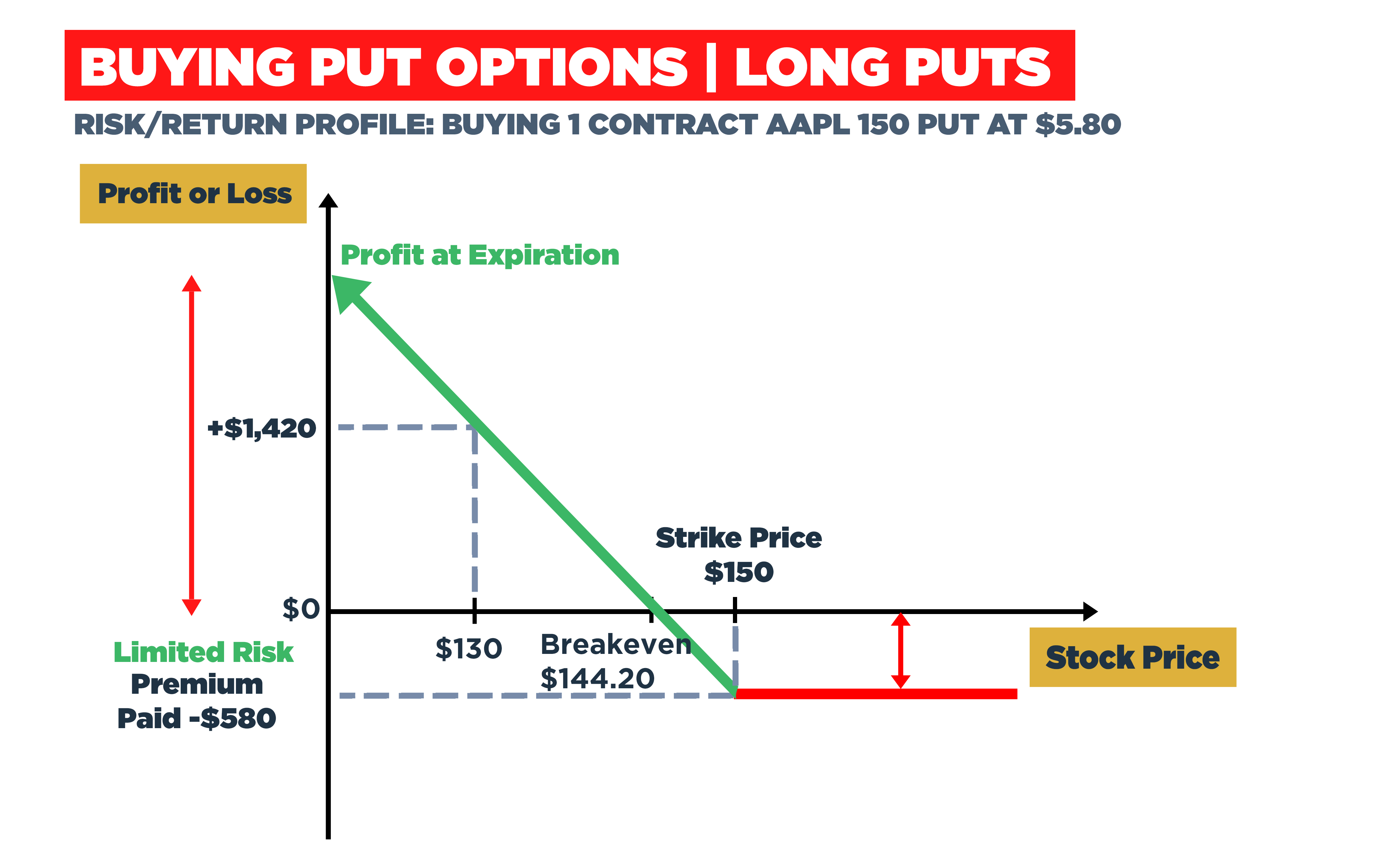

Buying Put Options

Buying a put option gives you the right (but not the obligation) to sell the underlying asset at a specified price (strike price) within a certain timeframe (until expiration).

Example: Buying Put Options

So if you’re instead bearish on Apple’s stock, assuming it’s currently trading at $150 per share, you would buy a put option with a strike price of $150, with an expiration date in one month, and you pay a premium of $5.80 per share for example.

If, by the expiration date, the price of Apple’s stock drops below $144.20 (strike price of $150 - premium paid of $5.80), you can exercise your put option.

If the stock price falls to $130 per share, you can exercise your put option to sell the shares at $150 (strike price) and buy the shares back at $130 per share in the open market, earning you a $14.20 profit per share ($150 - $130 - $5.80). If you bought 1 contract (1 contract = 100 shares), your total profit would be $1420.

If the price of the stock didn’t decrease as anticipated or didn’t drop below the strike price by the expiration date, the put option would expire worthless, and you would lose the premium paid of $5.80 per share.

Profit Potential

The profit potential when buying a put option is significant if the price of the underlying asset drops substantially. As the price falls below the strike price, you can exercise the option to sell the asset at the higher strike price, then buy it back at the lower market price, thus profiting from the price difference minus the premium paid for the option.

Put option buyers are bearish on the market. They profit when the stock price goes down.

Risks of Buying Put Options

One of the primary risks of buying a put option is that the price of the underlying asset doesn't decrease as anticipated or doesn't decrease enough to cover the premium paid for the option. If the asset's price remains above the strike price at expiration, the put option expires worthless, resulting in a loss of the premium paid.

Like call options, put options are subject to time decay, which can erode the option's value if the price of the underlying asset doesn't move quickly in the desired direction.

III. Selling Options Calls and Puts

Selling Call Options

When you sell a call option, you’re giving someone the right to buy the underlying asset from you at a specified price (strike price) within a certain time frame, which is the expiration date of the contract.

When you sell a call option, you’ll receive a premium upfront in exchange for taking on the obligation to sell the asset if the option is exercised.

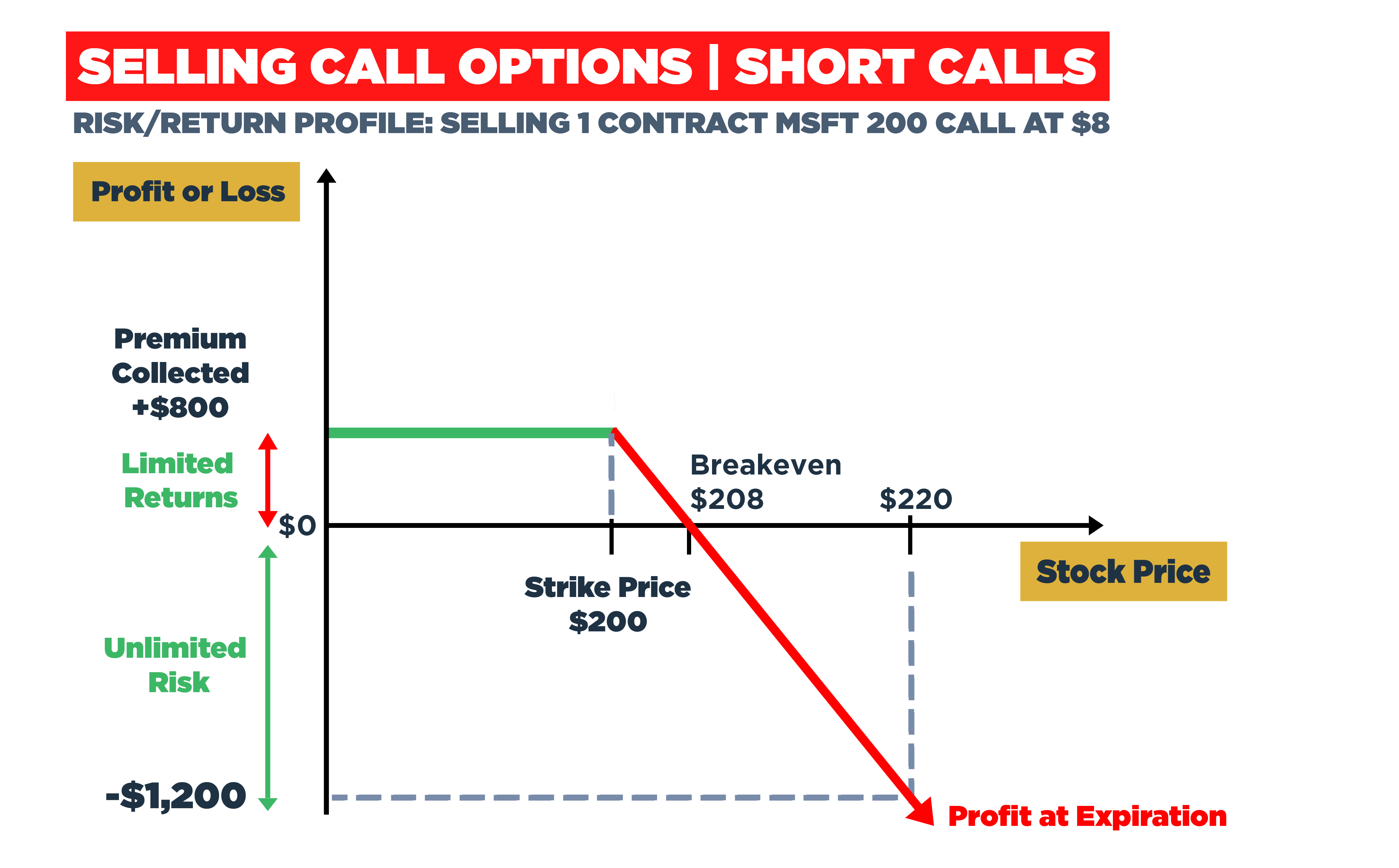

Example: Selling Call Options

Let's consider a scenario where you already own 100 shares of Microsoft stock, currently trading at $200 per share. You believe that the stock price will remain relatively stable in the next month.

So, you decide to sell a call option for Microsoft with a strike price of $200 and an expiration date of one month. A buyer pays you a premium of $8 per share for the option.

If, by the expiration date, the price of Microsoft's stock remains below $200 (the strike price), the option will expire worthless, and you get to keep the premium of $8 per share as your profit.

However, if the stock price rises above $200 and the option is exercised, you may be obligated to sell your 100 shares of Microsoft stock at the strike price of $200 per share, regardless of the current market price.

For instance, if the stock price rises to $220 per share, you would be required to sell your shares at $220 per share, resulting in a loss of $12 per share ($200 - $208), in addition to the premium received. That would be a total loss of $1200 after factoring in the $800 premium you'd have received at the beginning.

In this example, your breakeven point would be $208 per share ($200 + $8 premium received). If the stock price rises above this level, you will incur a loss on the trade.

Selling call options can generate income through the premium received, but it also exposes you to the risk of having to sell your shares at a potentially lower price than the market price if the option is exercised. Therefore, it's essential to consider your outlook on the stock's price movement and your risk tolerance before engaging in selling call options.

Profit Potential

Your profit potential is limited to the premium that you receive upfront. If the price of the underlying asset stays below the strike price, and the option is not exercised, you keep the premium as your profit.

Call option sellers are bearish. They profit when the price goes down or sideways.

Risks of Selling Call Options

The biggest risk of selling call options is the exposure to unlimited risk if the price of the underlying asset increases significantly, as there is no limit to how high the price can go.

If the price of the underlying asset rises above the strike price, you would be forced to sell the asset at a loss if your options contract is exercised.

WARNING: It is dangerous to sell calls “naked” (i.e. sell the option without owning the underlying shares). If the contract is exercised, you would be forced to buy the asset at a higher market price to fulfill your obligation to sell it at a lower price.

Selling Put Options

When you sell a put option, you’re granting someone else the right to sell the underlying asset to you at a specified price (strike price) until the expiration date.

Just like selling a call option, you’ll receive a premium upfront in exchange for taking on the obligation to buy the asset if the option is exercised.

Example: Selling Put Options

.jpg?width=1044&height=648&name=5%20(1).jpg)

Consider the following scenario: you want to acquire Apple stock, which is now trading at $160 per share, but you want to pay less.

So you decide to sell an Apple put option with a $150 strike price and a one-month expiration date. A buyer will pay you a premium of $5.80 per share for the option.

If the price of Apple's stock stays above $150 (the strike price) on the expiration date, the option will expire worthless, and you will profit from the premium of $5.80 per share, or $580 in total (since each contract represents 100 shares).

However, if the stock price goes below $150 and the option is exercised, you will be required to purchase 100 shares of Apple stock at $150 per share, regardless of the current market price.

For example, if the stock price falls to $130 per share, you must purchase the shares at $150 per share, resulting in a $20 per share loss ($150 - $130). However, since you collected $5.80 per share in premium, your net loss is $14.20 per share or $1,420 total ($14.20 × 100 shares).

In this case, your breakeven point would be $144.20 per share ($150 strike price minus the $5.80 premium received). If the stock price falls below this level, you will start losing money on the trade.

Selling put options can generate income through the premium collected, but you also risk having to acquire the underlying asset at a higher price than the market price if the option is exercised. Before selling put options, you should assess your view on the stock's price movement as well as your risk tolerance.

Profit Potential

Your profit potential when selling a put option is limited to the premium received upfront. As long as the price of the underlying asset remains above the strike price and the option is not exercised, you’ll keep the premium as pure profits.

Put option sellers are bullish. They profit when the price goes up or sideways.

Risks of Selling Put Options

If the price of the underlying asset falls below the strike price and the option is exercised, you will be required to buy the asset at a higher price than the market price, resulting in a potential loss.

If the stock price falls significantly, your losses will be substantial. In the worst-case scenario, if the stock price falls to zero, you would still be obligated to buy the stock at the strike price.

WARNING: Selling naked puts (i.e. selling the option without having enough money to buy the shares) is risky. If the option is exercised, you must buy the shares at the strike price, which could be much higher than the current market price, leading to large losses.

IV. Summary of Calls and Puts

Buyers and Sellers: Two Sides of Every Option Contract

Now that you understand what calls and puts are, it’s time to look at the two sides who make the trade possible. The buyer and the seller (also called the writer). Every option contract has both sides, each with its own rewards, risks, and mindset.

The Buyer: Paying for Opportunity

The buyer pays a premium to gain the right (but not the obligation) to buy or sell the underlying stock at a fixed price.

|

Goal |

To Profit From Movement in The Stock Price |

|

Risk |

Limited to Only the Premium Paid |

|

Reward |

Potentially Unlimited(for calls) or large (for puts) if the stocks moves sharply in their favor |

|

Mindset |

Opportunistic. Buyers are speculating on direction or volatility. Risk a small amount for a chance of a big payoff whilst time works against them. |

The Seller: Getting Paid for Taking Obligation

The seller receives the premium upfront and takes on the obligation to fulfill the contract if the buyer exercises it.

|

Goal |

To Collect Income By Selling their Obligation to the Buyer |

|

Risk |

Can be large if market moves sharply against their position |

|

Reward |

Limited to the Premium Collected |

|

Mindset |

Strategic and Disciplined. Sellers behave like insurers, earning small but steady returns with time working in their favor. |

Let’s Put it All Together…

|

Call |

Put |

|

|

Buyer |

Have the RIGHT to BUY 100 Shares at the Strike Price |

Have the RIGHT to SELL 100 Shares at the Strike Price |

|

Seller |

Have the OBLIGATION to SELL 100 Shares at the Strike Price |

Have the OBLIGATION to BUY 100 Shares at the Strike Price |

Which Side is Easier to Start With?

Most beginners think buying options is simpler because your loss is capped at the premium you pay. In practice, selling options are more forgiving — if done correctly.

When you sell an option, you’re effectively taking the other side of the buyer’s bet. Time now works in your favor, because every day that passes without a big move reduces the option’s value. As a buyer, you need the market to move in the right direction and move sharply enough for you to make a profit.

However, selling naked options without owning the shares or setting aside enough capital is risky. If the market moves sharply against you, losses can pile up fast. That’s why new traders should never sell options “uncovered” or Naked.

The safer path begins with defined-risk selling, where you understand exactly what you could lose before placing the trade. Think of it as earning steady income for taking calculated risks.

In short: buyers pay for potential, sellers get paid for patience. And patience, in options, is often the more reliable teacher.

Hear from our Options Mentor Bang Pham Van on why being a seller is a better way to start.

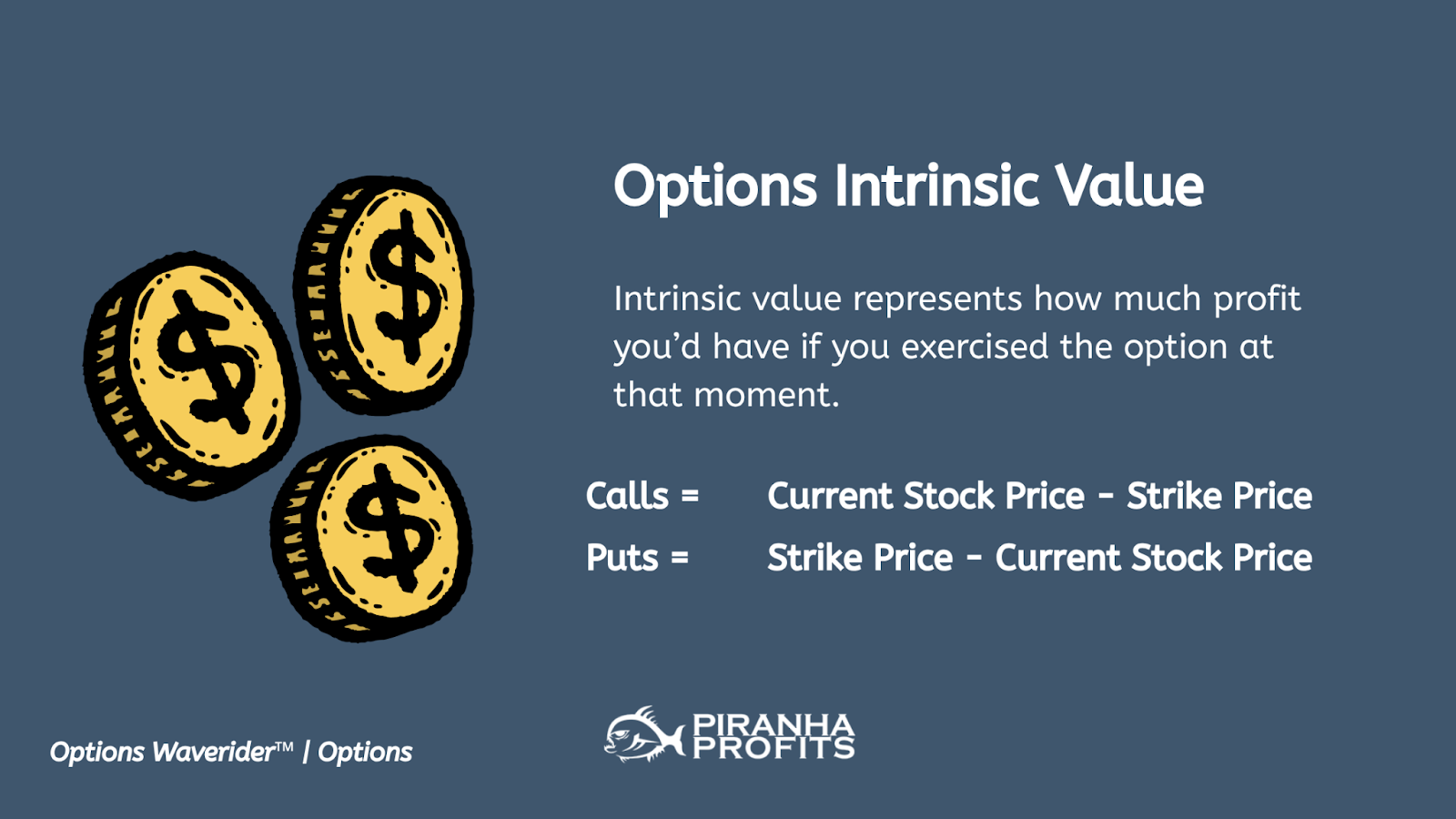

V. Intrinsic Value of Calls and Puts

The intrinsic value of an option is simply the value that would be realized if the option were immediately exercised.

For both call options and put options, the intrinsic value is determined by the relationship between the option's strike price and the current market price of the underlying asset. So let's look at the following tables to get a clear visual of what this means.

Intrinsic Value of Call Options

| Strike Price | If Current Market Price = $150 | Intrinsic Value |

| $160 | Out of the Money | $0 |

| $155 | Out of the Money | $0 |

| $150 | At the Money | $0 |

| $145 | In the Money | $5 |

| $140 | In the Money | $10 |

Intrinsic Value of Calls = Current Market Price - Strike Price

For call options, the intrinsic value is calculated by subtracting the strike price from the current market price of the underlying asset. If the market price is higher than the strike price, the call option has intrinsic value because you could exercise the option and immediately buy the asset at a lower price (the strike price) and sell it at the higher market price.

Intrinsic Value of Put Options

| Strike Price | If Current Market Price = $150 | Intrinsic Value |

| $160 | In the Money | $10 |

| $155 | In the Money | $5 |

| $150 | At the Money | $0 |

| $145 | Out of the Money | $0 |

| $140 | Out of the Money | $0 |

Intrinsic Value of Puts = Strike Price - Current Market Price

For put options, the intrinsic value is calculated by subtracting the current market price of the underlying asset from the strike price. If the market price is lower than the strike price, the put option has intrinsic value because you could exercise the option and immediately sell the asset at a higher price (the strike price) than its current market price.

Why It's Important

The intrinsic value represents the option's "real" worth in relation to the underlying asset's price. If an option has intrinsic value, it means there is a concrete benefit that can be earned by exercising it right now. On the other hand, if an option has no intrinsic value, it is referred to as "out-of-the-money" and consists solely of temporal value.

Understanding the intrinsic value is critical for options traders who want to make sound trading decisions. It allows traders to determine the break-even point for their option contracts and assess prospective profit or loss possibilities.

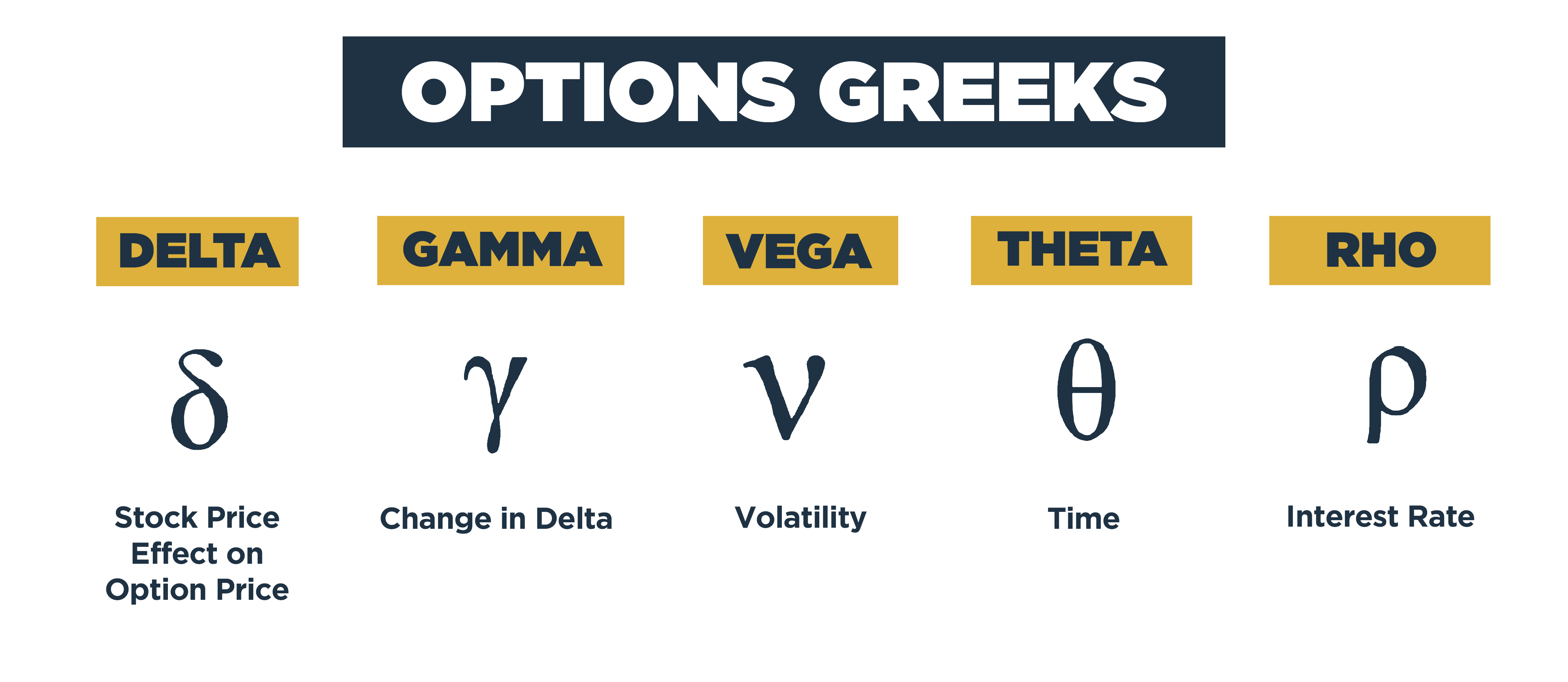

VI. Understanding Option Greeks

Option Greeks are like a trader's compass, guiding you through the twists and turns of the options market.

These Greeks—delta, gamma, theta, vega, and rho—act as indicators, showing how options react to different factors. From changes in the asset's price to the passing of time and shifts in volatility, they cover everything that influences an option's price.

By understanding these Greeks, you will be able to steer your trades better, making smarter choices and staying on top of risk.

δ — Delta

Definition:

Delta measures how much an option’s price is expected to change for a $1 change in the underlying asset’s price.

Behavior:

-

Call options: Delta ranges from 0 to +1.

-

Put options: Delta ranges from 0 to −1.

-

At-the-money options have Delta near 0.5 (calls) or −0.5 (puts). Example: for every $1 increase in the underlying asset's price, the At-the-Money option's price will increase by $0.50 (for call options) or decrease by $0.50 (for put options).

-

Delta increases (for calls) or decreases (for puts) as the option moves deeper in-the-money.

Insight:

Delta represents both the hedge ratio (number of shares to hedge one option) and the approximate probability of expiring in the money.

γ — Gamma

Definition:

Gamma measures the rate of change of Delta with respect to changes in the underlying price — the second derivative of the option’s price.

Behavior:

-

Highest for at-the-money options.

-

Decreases as options move in-the-money or out-of-the-money.

-

Increases as expiration approaches.

Insight:

High Gamma means Delta changes rapidly with small price moves — requiring frequent hedging adjustments (Gamma risk).

𝑉 — Vega

Definition:

Vega measures how much an option’s price changes for a 1 percentage point change in implied volatility.

Behavior:

-

Highest for at-the-money options.

-

Decreases as options move deeper in- or out-of-the-money.

-

Increases with longer time to expiration and drops sharply near expiry.

Insight:

Options with high Vega are most sensitive to volatility shifts — important for traders focusing on implied volatility strategies. Vega tends to remain elevated leading up to earnings announcements, as implied volatility rises in anticipation of potential price swings. After earnings are released and uncertainty is removed, implied volatility — and hence Vega’s effect — typically drops sharply (volatility crush).

θ — Theta

Definition:

Theta measures the rate of time decay — how much an option’s price decreases as time passes, all else equal.

Behavior:

-

Negative for long options (time works against buyers).

-

Greatest (most negative) for at-the-money options.

-

Accelerates as expiration approaches.

Insight:

Theta quantifies the “cost of holding time.” Option sellers benefit from Theta decay; buyers lose value daily if the market doesn’t move enough.

ρ — Rho

Definition:

Rho measures how much an option’s price changes for a 1% change in interest rates.

Behavior:

-

Positive for call options (higher rates increase call prices).

-

Negative for put options (higher rates decrease put prices).

-

More significant for long-dated options; minimal for short-term ones.

Insight:

Rho is usually the least impactful Greek, but becomes relevant in high-rate or long-maturity environments.

VII. Options Trading Strategies for Beginners

Strategy 1: Long Calls & Long Puts

In the earlier sections, you learned about buying calls and puts. Long calls and long puts are just that — they’re the most basic options strategies, where you would simply buy either a call option contract or a put option contract.

This is a good strategy to start with if you’re starting off with a small account since it allows you to control high-priced stocks with minimal capital.

You would buy a long call when you expect the price to move up sharply. You’re essentially betting that the stock’s price will go up beyond the strike price before the options expire.

Vice versa, when you buy a long put, you’re anticipating that the price will move down sharply, and you’re betting that the stock price will drop below the strike price before the options expire.

The only risk or cost associated with both long calls and long puts is the premium that you’d have to pay for the options contract, meaning that your loss is already pre-defined.

The premium amount would also vary depending on factors such as the current stock price, the strike price, and how much time remains until expiration. You’d also have to pay this premium upfront.

They’re both relatively easy to understand and use. There’s a pre-defined (limited) risk, and your upside potential for long calls is theoretically unlimited, whereas with long puts the upside is limited but could still be significant.

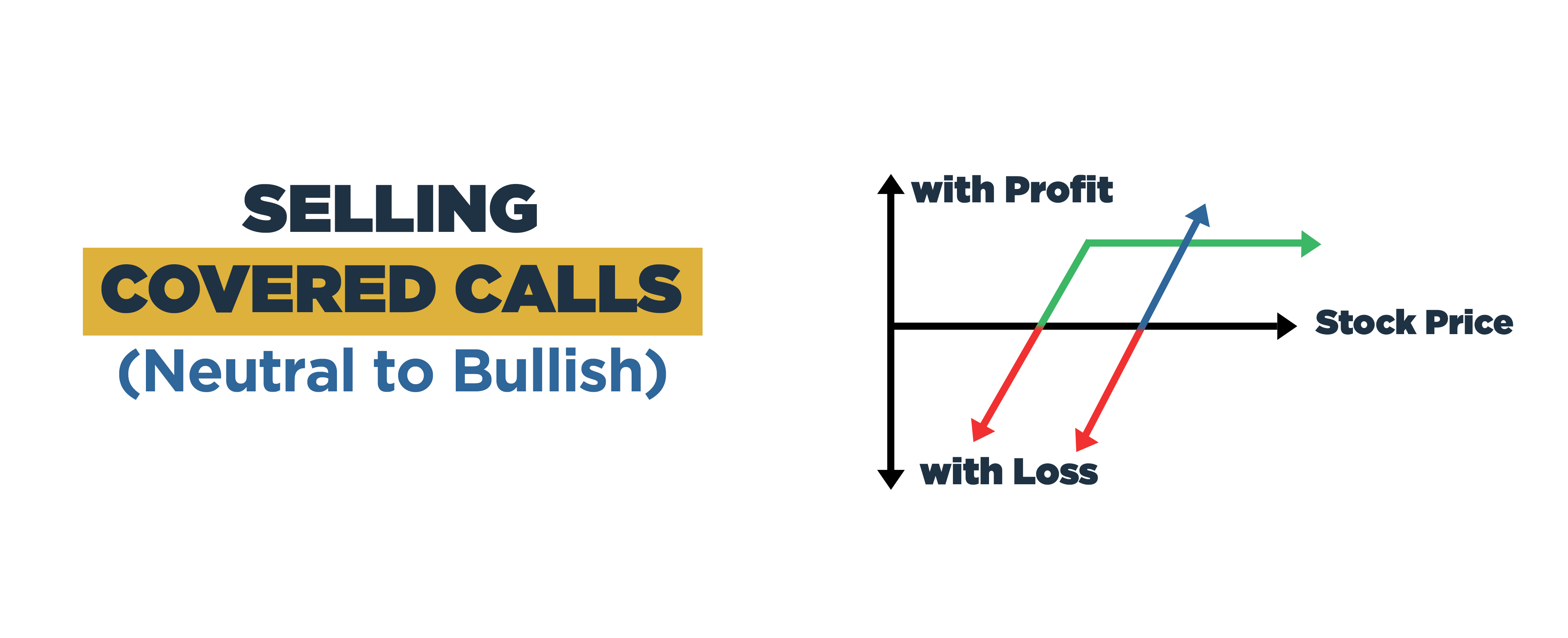

Strategy 2: Covered Calls

If you’re already a long-term investor with a sizable portfolio, covered calls may prove to be a useful options trading strategy.

So when you hold a portfolio of great companies, you make money mainly through capital gains where the stocks increase in price, at the same time you collect dividends from certain stocks. But there’s a third stream of income that many investors overlook, which is collecting options premium by selling covered call options.

Despite it being a relatively basic options trading strategy, covered calls are used by experienced investors who want a higher return on their investments.

It involves selling a call option on a stock you already own. The call option gives the buyer the right to buy the stock from you at the strike price.

So yes, you would first need to own shares of the underlying stock for this strategy to ensure that you can fulfill your obligation if the call option is exercised.

You would typically use this strategy if you anticipate a stock to be stagnant, if you’re slightly bearish on the stock or you are willing to sell your stock anyways.

If the stock price remains below the strike price until the expiration date, the options contract will expire worthless — which is great news for you, as you’d get to keep the premium the buyer had to pay you upfront as pure profits.

You’d only lose if the stock price rises above the strike price and if the buyer exercises the option. You’d sell your shares to the buyer at the strike price regardless of the current market price. You’d still keep the premium received, but your potential profit from the stock sale is capped at the strike price.

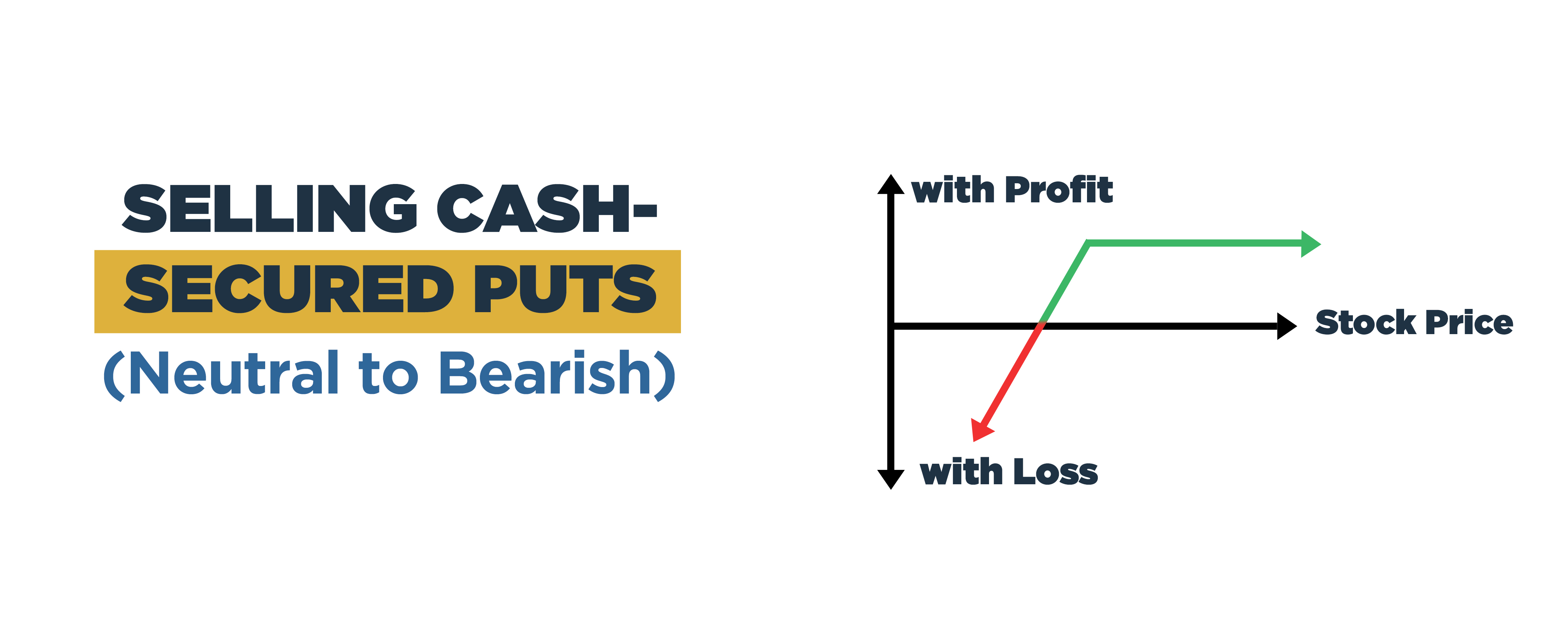

Strategy 3: Cash-Secured Puts

If you’re a stock investor or looking to start investing, this strategy will allow you to buy a stock at a discount or even for free! Remember that when you sell a put, you’re betting that the stock price will go up or go sideways as long as it stays above the strike price.

When you use this strategy, at worst if the stock price does indeed go down below the strike price, the put option would likely get exercised and you’ll have to buy the stock at the strike price, even if the market price of the stock at that time is lower than the strike price.

Make sure you have enough cash in your account to buy the stocks (hence the term cash-secured), and only apply this strategy on fundamentally good stocks that you are looking to add to your portfolio for the long term.

So at best, you’ll keep the premiums as pure profits, and at worst you’ll end up owning a good stock at a discount from the price at the time you sold the put option contract.

It’s a simple win-win strategy that holds amazing benefits for investors.

Strategy 4: Bull Call Spread

The Bull Call Spread is basically a more effective (and cost-efficient) method of going long on a stock or an exchange-traded fund (ETF) as compared to simply buying a call option.

The way this works is that you would buy and sell a call option at different strike prices. Remember that when you buy a call option, you’d have to pay a premium, so when you sell a call option as well you would in turn receive a premium. This way, your initial upfront cost of the trade is reduced (premium paid - premium received).

This lower upfront cost of the trade comes at the cost of capping your potential profit. You would use this strategy when you’re bullish on a stock or ETF, and you have a target price. Compared to just buying a call, this method has a lower risk and a better risk-to-reward ratio.

VIII. Options Trading Risks and Considerations

Market Risks

Market risks refer to the chance of losing money due to the overall market moving in a bad direction. These risks can make stock prices go down, which also affects options. Things like economic changes, world events, and news about specific industries can cause market risk. If you want to trade options, it's important to keep learning about what's happening in the broader market that might affect your investments or trades.

Time Decay

Time decay, or theta decay, is when an option loses value over time. Options have expiration dates, and as that date gets closer, the option's value decreases. This happens even if the price of the underlying asset isn't moving as you hoped. Time decay speeds up as the expiration date gets closer, so it's important to consider timing when making trades.

Insights: Option sellers benefit from Theta decay; buyers lose value daily if the market doesn’t move enough.

Implied Volatility

Implied volatility shows what the market thinks about how much an asset's price will change in the future, based on option prices. High implied volatility means the market expects big price swings, while low implied volatility means it expects less movement. When implied volatility goes up, so do option prices. You need to keep an eye on implied volatility to make smart choices when trading options.

IX. Options Trading Tips for You

Start Small

When starting out in options trading, it's crucial for you to begin with small, manageable trades. Starting with a small account of at least $5,000 to $10,000 allows you to gain experience without risking significant amounts of capital. Starting off with trading long calls and long puts or spreads can be suitable if you're looking to keep your risk per trade low.

Expect to risk a few hundred dollars per trade, but as long as you keep your risk per trade to about 2% of your total account value, it's a good start to learn and practice.

As you become more comfortable with the process and gain confidence in your trading strategy, you can gradually increase the size of your trades as your account grows — while maintaining the 2% rule of course!

Typically, options traders would risk only 2% of their capital for each trade, to a maximum of 3% risk per trade.

Learn Continuously

Options trading is a complex and dynamic field that requires ongoing learning and education. Beginners should dedicate time to continuously expanding their knowledge through books, online resources, and options trading courses. Staying informed about market trends, trading strategies, and risk management techniques is essential for success in options trading.

Risk Management, Risk Management, Risk Management!

Effective risk management is critical for protecting your capital and minimizing losses in options trading. Beginners should develop and adhere to risk management strategies that define their maximum acceptable risk per trade and overall portfolio. This may include setting stop-loss orders, diversifying positions, and limiting the size of trades relative to account size.

Paper Trading

Paper trading, also known as simulated or virtual trading, is an excellent way for beginners to practice trading without risking real money. Many brokerage platforms offer paper trading accounts that allow traders to place simulated trades using virtual funds. Paper trading provides an opportunity to test trading strategies, gain experience, and refine skills before transitioning to live trading with real money.

Essentials When Trading Options

Successful options trading isn’t just about selecting the right strike or expiry. The following tools help you identify setups and plan your capital.

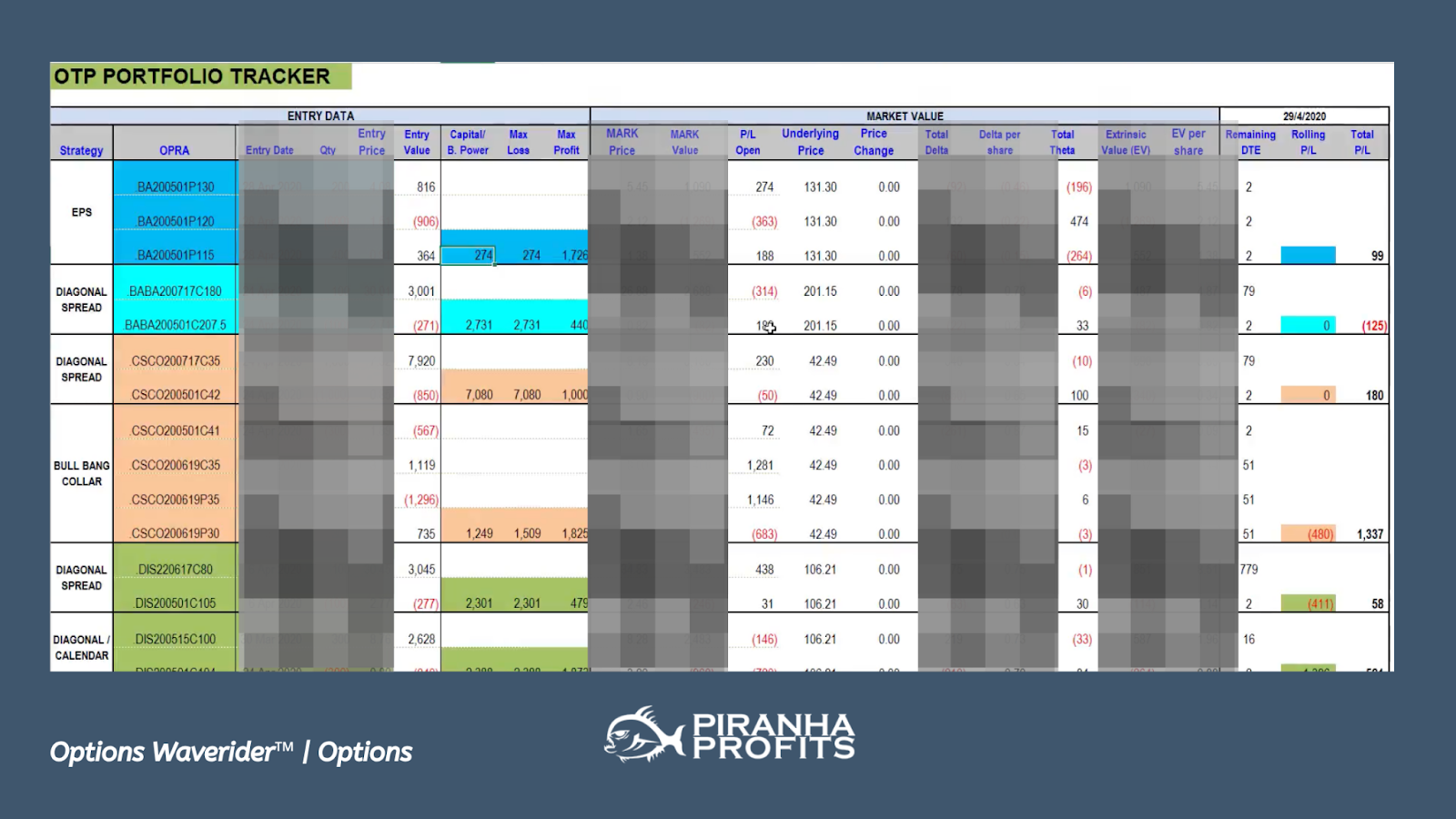

Portfolio Tracker For Options Positions Visibility And Planning

As your options portfolio grows, keeping track of multiple strategies covered calls, cash-secured puts, spreads, and more becomes essential. A portfolio tracker gives you a structured view of every open and closed position, helping you make informed decisions instead of emotional ones.

The example below shows a sample Options Portfolio Tracker, which breaks down every position into key components:

Options Portfolio Tracker by Options Waverider™ Piranha Profits

A portfolio tracker keeps your trading organized and your decisions data-driven. Here’s what you should track :

Entry Data: Records your trade setup. Strategy type, entry date, quantity, capital used, and risk/reward.

Market Value: Shows how your trades are performing live through mark price, delta, theta, and underlying movement.

Profit & Loss: Tracks open, rolled, and total P/L so you know what’s working and what’s not.

Days to Expiration (DTE): Helps manage timing. Knowing when to roll, close, or let trades expire.

Together, these sections give you a clear view of your positions, performance, and progress.

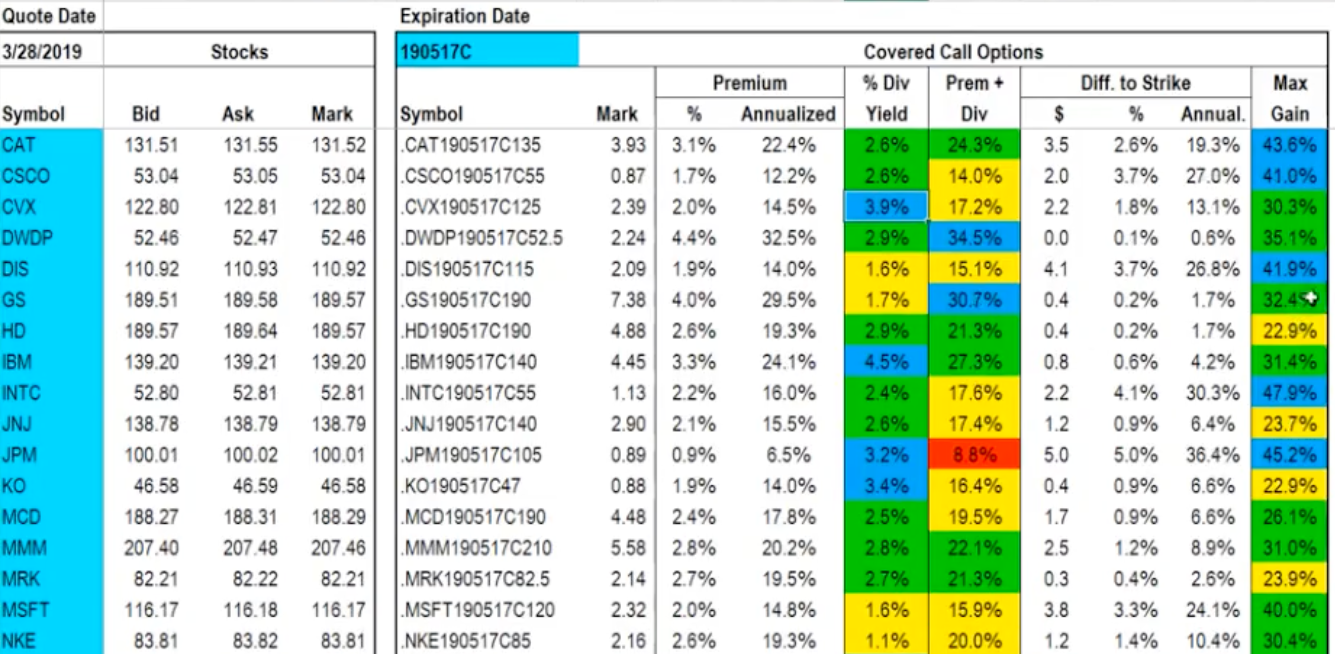

Covered Call and Cash Secured Put Scanner to Find the Right Opportunities

When managing an options portfolio, scanning the market manually for setups can be time-consuming. That’s where scanners come in. Automated tools that filter through hundreds of stocks to find trades that meet your exact criteria. Whether you’re selling covered calls or cash-secured puts (CSPs), scanners help you focus only on high-quality, high-probability setups.

The example shown here highlights how a Covered Call and CSP Scanner displays important trade metrics such as premium yield, annualized return, dividend yield, and distance to strike easily, before executing a trade on your platform.

Options Scanner by Options Waverider™ Piranha Profits

Each column in the covered call scanner provides data that helps identify the best opportunities:

Symbol & Mark: The stock or option being evaluated and its current market price.

Premium % / Annualized: Shows how much return you can expect from selling the option — annualized to compare opportunities across expirations.

Dividend Yield: Adds a second income source for dividend-paying stocks.

Premium + Dividend (%): Combines both income streams for total yield potential.

Diff. to Strike ($ / %): Measures how far the strike is from the current stock price.

Max Gain: The total percentage gain if the trade plays out perfectly (premium + potential upside).

These figures help traders immediately spot which stocks offer the best balance of premium yield, safety, and potential upside.

Keep Going

As a beginner, trading options can be tough at the start. You’re not only battling against other traders, but you’re also combating your own emotions like fear and greed.

It takes a lot of discipline and commitment to stay consistent in watching the markets, looking for entry signals for your strategies, and managing your trades. But keep going, as it does indeed get easier with experience, and you’ll find the outcome to be the most rewarding.

We have thousands of options trading students in our Piranha Profits community who have achieved success year after year. What many of them do is that they focus on one or two options trading strategies that suit their style and temperament, and they keep practicing.

Resources for Further Learning

The first step is believing you can fully commit to trading firmly. And the next step will be to get a solid foundation of your knowledge.

But don’t stay in the learning phase for too long — dip your toes in the water and start trading.

Yes but you'll need to start small and manage expectations.

With $100, you might not be trading advanced strategies or buying expensive contracts, but you can buy lower-cost options on stocks with cheaper premiums (like under $1). Focus on learning and practicing, not making big returns.

Consider starting with paper trading (simulated trades) to build confidence without risking real money. Once you understand the basics, you can look into strategies like buying single call or put options on affordable stocks.

Yes — but only if you're willing to learn.

Options trading can be an excellent tool once you understand the risks, rewards, and strategies. It gives you flexibility to trade in any market condition. Unlike stock investing, it’s not “set and forget.” You’ll need to study, practice, and manage trades actively.

Not if you know what you're doing.

Options can feel like gambling if you're taking wild guesses or chasing hype. But when you approach it with a strategy, risk management, and education, it becomes a calculated form of trading, not a bet.

Options have expiration dates, which can range from weekly, monthly and yearly.

Once the expiration date passes, the option either becomes worthless or is exercised if it's in the money.

submit your comment